Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Chinese live lecture today's preview

- When is a head for gold fluctuation? Follow 3355-3325 tonight, ;;

- The United States and the European Union are expected to reach a tariff agreemen

- Analysis of the latest trends of gold, USD index, yen, euro, pound, Australian d

- The dollar index is competing for long and short, CPI and Jackson Hall meeting a

market analysis

A collection of positive and negative news that affects the foreign exchange market

Wonderful introduction:

Optimism is the line of egrets that are straight up to the blue sky, optimism is the thousands of white sails beside the sunken boat, optimism is the lush grass that blows with the wind on the head of the parrot island, optimism is the falling red spots that turn into spring mud to protect the flowers.

Hello everyone, today XM Foreign Exchange will bring you "【XM Foreign Exchange Market Analysis】: Highlights of positive and negative news that affect the foreign exchange market". Hope it will be helpful to you! The original content is as follows:

1. Central Bank policy trends and market expectations

(I) The Federal Reserve maintains interest rates unchanged, and expectations of interest rate cuts are differentiated

The Federal Reserve maintains the federal funds rate in the range of 4.25%-4.5% in the interest rate resolution announced in the early morning of July 31, which is in line with market expectations. However, two directors rarely voted against the policy decisions, the first time since 1993 that two directors opposed policy decisions at the same time. The market's differences on future rate cuts are intensifying: Current federal funds futures show that the probability of a 25 basis point cut in September is about 68%, but some hawkish officials still emphasize the need to observe the sustainability of inflation data. This resolution has a neutral and bearish impact on the US dollar. If subsequent inflation data are weak, the US dollar may be under further pressure.

(II) The European Central Bank suspends interest rate cuts, focusing on trade negotiations

At the meeting on July 26, the European Central Bank decided to keep the three key interest rates unchanged and suspend the interest rate cut cycle, mainly due to the intensification of uncertainty in US-EU trade negotiations. The EU expressed concerns about the possible 30% tariffs imposed by the United States, and if negotiations break down, it could affect the eurozone economy through demand suppression and supply chain disturbances. The current unemployment rate in the euro zone remains at a historical low of 6.3%, while the initial annualized CPI rate in July reached 1.7%, slightly higher than expected, providing support for the euro in the short term. But if trade frictions escalate, the euro may return to the downward channel.

(Wednesday) The Bank of England sent dovish signals, and expectations for a rate cut in August heated up

The Bank of England held the benchmark interest rate unchanged at 4.25% with a 6:3 split vote at the policy meeting on July 31, but the minutes of the meeting showed that the three www.xmserving.committee members supported an immediate rate cut of 25 basis points, and the labor market was weakand slower wage growth has become the main concern. The market has fully digested the expectation of a 25 basis point interest rate cut in August and is expected to cut interest rates again this year, which caused the pound to fall 0.1% against the US dollar to 1.3248 on the day. If subsequent employment data continue to deteriorate, the pound may accelerate its downward trend.

(IV) The Bank of Japan maintains its wait-and-see, and long-term interest rate hikes are expected to support the yen

The Bank of Japan maintains the benchmark interest rate at 0.5% at its meeting on July 31, and implies that it will not adjust its policies in the short term. Although Tokyo's core inflation is still above target, the central bank stressed the need to observe the impact of U.S. tariffs on exports and corporate confidence. However, previous review www.xmserving.committee member Takada Takada had said that the interest rate hike cycle was only a "suspended". In the medium and long term, if the Japanese economy continues to recover, the yen may gain support. Technically, the US dollar/JPY fell 0.16% on the day to 149.26, close to the daily PP resistance level of 149.46, so we need to be wary of the risk of pullback.

(V) The RBA is cautious in cutting interest rates, and the Australian dollar stabilizes and rebounds

Minutes of the RBA's July meeting showed that despite high global economic uncertainty, the bank believes that the reason for the current interest rate to remain at 3.85% is "more sufficient", implying that there will be no further interest rate cuts in the short term. This statement eased the market's concerns about the continued depreciation of the Australian dollar. In addition, China's official non-manufacturing PMI rose to 50.5 on the same day, boosting expectations of www.xmserving.commodity demand. The Australian dollar rose slightly by 0.04% against the US dollar to 0.6514 on the same day. If iron ore prices stabilize in the future, the Australian dollar may continue its rebound trend.

2. Geopolitics and international trade events

(I) South Korea and the United States have reached a trade agreement, and tariff pressure is eased

South Korean President Lee Zaiming announced on July 31 that South Korea and the United States have reached an agreement on tariff issues: the United States' tariffs on South Korea will be reduced to 15%, and South Korea promises to invest US$350 billion in the United States, of which 150 billion is used for shipbuilding cooperation. This agreement eliminates uncertainty in South Korea's exports and is positive for the won in the short term, but may indirectly affect Asian currencies such as the Japanese yen and the Australian dollar through supply chain adjustments. The market needs to pay attention to the details of the agreement implementation and its long-term impact on the global trade landscape.

(II) The Russian Far East Special Economic Zone plans to trigger expectations of capital flows

The Chief Executive of the Russian Khabarovsk Krai Region announced on July 31 that it will establish an "International Advanced Development Zone" on Heixiazi Island, and the construction is planned to start in 2026. The SAR will provide legal protection for foreign investors to evade Western sanctions, which may attract Chinese capital inflows and promote cross-border settlement demand for RMB. This move may indirectly affect the US dollar/RMB exchange rate. If the diversification of Sino-Russia trade settlement accelerates, the US dollar's dominance in the Far East may weaken.

(III) The Kamchatka earthquake triggered risk aversion

The magnitude 8.7 earthquake occurred in the waters near the Kamchatka Peninsula in Russia on July 30, triggering a tsunami warning from many countries along the Pacific coast. Risk aversion sentiment pushed the yen and the US dollar to strengthen in the short term, and the US dollar index once rose to 99.746, close to the PP resistance level of the daily chart. However, as the impact of the tsunami subsided, market risk appetite gradually rebounded, and the US dollar and the Japanese yen subsequently gave up some of the gains.

3. Economic data and market sentiment

(I) The resilience of the US job market supported the US dollar

The number of layoffs of challenger www.xmserving.companies in the United States fell to 48,000 in July, a year-on-year decrease of 1.6%, indicating that the labor market is still resilient. This data strengthens the rationality of the Fed's "waiting and watching" position and provides support for the US dollar in the short term. However, if subsequent non-agricultural data are less than expected, expectations of interest rate cuts may heat up again, suppressing the US dollar exchange rate.

(II) Eurozone inflation data differentiation

The unemployment rate in the euro zone remained at a historical low of 6.3% in June, and the initial annual CPI rate in Italy in July reached 1.7%, slightly higher than expected, indicating that the core inflation pressure has rebounded. However, overall inflation expectations in the eurozone are still suppressed by trade uncertainty and the ECB may maintain a cautious stance. Technically, the euro/USD rose 0.26% to 1.1434 on the same day, breaking through the daily PP resistance level. If it stabilizes at this level, it may further rise to the 1.15 mark.

(III) www.xmserving.commodity currencies and crude oil prices were linked

International crude oil futures closed up more than 1% on July 30, with WTI crude oil at US$70/barrel and Brent crude oil at US$73.24/barrel. Rising crude oil prices support www.xmserving.commodity currencies such as the Australian dollar and the Canadian dollar, but we need to be wary of global inflation concerns caused by high oil prices. If geopolitical tensions continue, the positive correlation between crude oil and www.xmserving.commodity currencies may be further strengthened.

4. Key points and trading strategies in the technical field

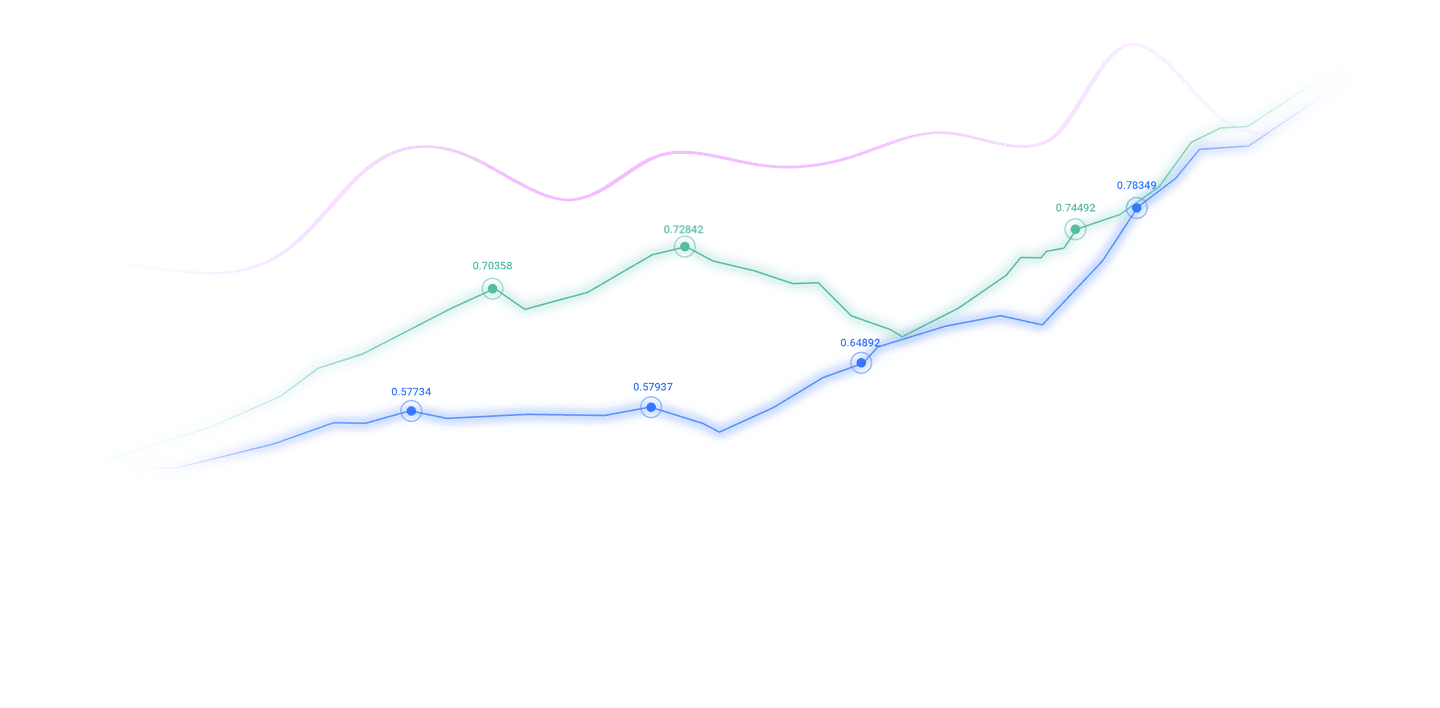

(I) US dollar index: Pay attention to the breakthrough of the range of 98.06-99.74

The US dollar index fell slightly by 0.09% to 98.88 on the same day, near the pivot point of the daily chart. The key support level is 98.06 (Presponder of the daily chart), if it falls below, it may fall to 97.50; the resistance level is 99.74 (Presponder of the daily chart), and if it breaks through, it will open upward space to the 100 mark. Short-term traders are advised to pay attention to the direction of the range breakthrough, while mid-term investors can place short orders at high prices.

(II) Euro/USD: 1.1434 is a long-short watershed

Euro/USD closed at 1.1434 on the same day, breaking through the daily PP resistance level, and the short-term trend turned bullish. If you stand firm at this level, the next target will be 1.1500; the support level below is 1.1350 (20-day moving average). If it falls back, you can try long with a light position. We need to be wary of the impact of the progress of US-EU trade negotiations on the exchange rate.

(III) GBP/USD: Pay attention to the support strength of 1.3200

GBP/USD fell 0.1% to 1.3248 on the day, close to the PP support level of 1.3200 on the day. If it falls below this level, it may fall to 1.3150; the upper resistance is 1.3300 (50-day moving average), and breaking through will alleviate downward pressure. Given the dovish position of the Bank of England, it is recommended toMainly high short selling.

(IV) USD/JPY: 149.46% of the key resistance

USD/JPY fell 0.16% on the day to 149.26, close to the PP resistance level of the day's chart 149.46. If it cannot effectively break through, it may pull back to 148.47 (Pivot point of the daily chart PP); the support below is 147.45 (Pivot support of the daily chart PP). The Bank of Japan's wait-and-see attitude may limit the yen's gains, and it is recommended to operate in ranges.

5. Risk warnings and operational suggestions

Geopolitical risks: US-European trade negotiations, Russian-Ukrainian conflicts and the situation in the Taiwan Strait may cause market risk aversion fluctuations, so we need to pay close attention to relevant news.

Data release: US non-farm employment data for July will be released on August 1. If it deviates significantly from expectations, it may trigger the market to reprice the Federal Reserve's policy path.

Position management: In the context of high market uncertainty, it is recommended to control positions to avoid excessive leverage. The "light position trial order + stop loss protection" strategy can be adopted to flexibly respond to market changes.

Summary: On July 31, the foreign exchange market showed a pattern of long-short interweaving, and the central bank's policy differentiation, geopolitical events and economic data jointly shape exchange rate fluctuations. The dollar is suppressed by expectations of interest rate cuts, the euro and yen are supported by data in the short term, while the pound and the Australian dollar are facing pressure on policy uncertainty. Investors need to www.xmserving.combine fundamental and technical analysis to grasp the opportunities for breakthroughs at key points, and at the same time beware of the impact of emergencies on the market.

The above content is all about "【XM Foreign Exchange Market Analysis】: Collection of Positive and Negative News that Influence the Foreign Exchange Market". It was carefully www.xmserving.compiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your trading! Thanks for the support!

In fact, responsibility is not helpless, it is not boring, it is as gorgeous as a rainbow. It is this colorful responsibility that has created a better life for us today. I will try my best to organize the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here