Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The US dollar/JPY tends to rise, and the trend is subject to the Fed's expectati

- Gold this week pays attention to breaking weekly support, while Europe and the U

- Gold prices continue to hit historical highs, pointing to the 3600 mark, weak US

- Chinese live lecture today's preview

- The dollar falls as focus turns to inflation data and Sino-US trade negotiations

market analysis

Undercurrents in the euro zone, analysis of short-term trends of spot gold, silver, crude oil and foreign exchange on July 30

Wonderful introduction:

A person's happiness may be false, and a group of people's happiness cannot tell whether it is true or false. They squandered their youth and wished they could burn it all, and that posture was like a carnival before the end of the world.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Market Review]: Undercurrents in the euro zone, analysis of short-term trends of spot gold, silver, crude oil and foreign exchange on July 30". Hope it will be helpful to you! The original content is as follows:

Global Market Review

1. European and American market conditions

The three major futures indexes rose, Dow futures rose 0.04%, S&P 500 futures rose 0.10%, and Nasdaq futures rose 0.20%. The German DAX30 index fell 0.10%, the UK FTSE 100 index fell 0.32%, the French CAC40 index fell 0.29%, the European Stoke 50 index fell 0.09%, the Spanish IBEX35 index fell 0.40%, and the Italian FTSE MIB index fell 0.32%.

2. Interpretation of market news

Undercurrents in the euro zone: the market mystery intertwined by the expectation of interest rate cuts and economic resilience

⑴ On the evening of July 30, Beijing time, the euro zone government bond yields remained stable. ⑵ Market focus has turned to the EU-US trade deal, and the euro's significant decline this week. ⑶ Investors are waiting for the Federal Reserve’s interest rate decision in the early morning of Thursday Beijing time, which makes the euro zone bond market unclear. ⑷As the tariff agreement between the EU and the United States reached a 15% tariff agreement on imported goods, tariff uncertainty subsided, and bond yields fell slightly this week. ⑸ Germany's 10-year government bond yield, as the euro zone benchmark, fell less than 1 basis point to 2.681%, and fell 3.5 basis points this week. ⑹This is the first weekly decline since late June. ⑺The latest data shows that the eurozone's economic growth in the second quarter was 0.1%, exceeding market expectations, showing the economy's resilience in the face of trade uncertainty. ⑻ING Chief Economist Bert Colijn pointed out that despite the uncertainty in the first half of the year, the www.xmserving.combined growth performance in the first two quarters did not make itPeople are disappointed. ⑼ The euro was under pressure this week, with a drop of 1.5%, the biggest weekly decline since November last year. ⑽Germany two-year government bond yields remained stable at 1.92%, down 2 basis points this week. ⑾The market's expectations for the European Central Bank to cut interest rates again this year have dropped to around 30%, and it is expected to cut interest rates as early as March next year.

July employment data reveals: Economic warmth and cold signals hidden behind the numbers

⑴ ADP report shows that there were structural changes in the employment data of the private sector in the United States in July, revealing the differentiated performance of different industries. ⑵The number of employment in the construction industry continued to grow, with 15,000 new people in July, accelerating from 9,000 in June, indicating that the field is still resilient. ⑶ The growth rate of employment in manufacturing slowed down, with only 7,000 people increasing in July, far lower than 15,000 people in June, showing a certain degree of cooling. ⑷ The trade, transportation and utilities sectors performed strongly, with employment increasing by 18,000 in July, up from 14,000 in June, heralding the continued expansion of the service sector. ⑸ The financial services industry rebounded strongly, with 28,000 new jobs in July, reversing the decline of 14,000 in June, becoming a highlight. ⑹In contrast, the professional and www.xmserving.commercial services industry increased by only 9,000 in July, although it improved by 56,000 less than in June, but it still needs to be wary of its subsequent trends.

Trump: India will pay 25% tariffs and fines

U.S. President Trump said on social platforms, remember that although India is our friend, we have relatively little trade with them over the years because their tariffs are too high, the highest in the world, and their non-monetary trade barriers are the most annoying of all countries. In addition, they have been buying the vast majority of military equipment from Russia and are Russia's largest energy buyers. India is not doing well at a time when everyone wants Russia to stop its military operations in Ukraine! Therefore, starting from August 1, India will pay a 25% tariff, plus a fine for the above actions.

U.S. housing refinancing applications fell for the third consecutive week

Seasonally adjusted data from the American Mortgage Banking Association (MBA) showed that the number of housing refinancing applications in the United States fell 1% this week, 30% higher than the same period last year. But the overall refinancing scale is still at a historical low, which is the third consecutive week of decline. It is worth noting that mortgage interest rates in the same period last year were only 1 basis point lower than the current period, almost flat.

The Thai Constitutional Court requires Petton to submit defense materials for unconstitutional cases on August 4

According to Xinhua News Agency, the Thai Constitutional Court issued a notice on the 30th that regarding the suspension of Prime Minister Petton, the court last agreed to extend the deadline for her to submit defense materials until August 4. The notice said that on July 29, Pettontan proposed to extend the deadline by 15 days, on the grounds that evidence is still being collected and the materials have not been www.xmserving.completed. After deliberation, the Thai Constitutional Court approved the approval of the voting results of 5 votes in favor and 4 votes against.It will be postponed to August 4 as the last postponement. If Pettontan fails to submit defense materials within the prescribed time limit, it is deemed to have waived the defense and the Constitutional Court will continue the trial procedure in accordance with the law.

The price of the Federal Reserve's "patience": Can a single vote of objection trigger a huge shock in the market?

⑴ In the early morning of Thursday, Beijing time, the Federal Reserve's interest rate resolution is about to be announced, and the market's primary focus will be the voting differences between the vote www.xmserving.committee. ⑵ Despite widespread expectations, Federal Reserve Director Waller has hinted that he may vote for a rate cut. ⑶Bowman also expressed an open attitude towards the interest rate cut in July, provided that inflation data meets expectations. ⑷ However, the latest Consumer Price Index (CPI) data show the initial impact of Trump's tariff rhetoric. ⑸ At present, most Fed officials tend to maintain a "patient" monetary policy stance. ⑹If there is even one vote of objection, the market is likely to make a hawkish reaction. ⑺The current market expects the possibility of a rate cut in September to be 60-65%, and this expectation is quietly rising. ⑻Any subtle policy signal may break the calm of the US dollar market and put traders holding short positions at risk.

3. Trends of major currency pairs in the New York Stock Exchange before the market

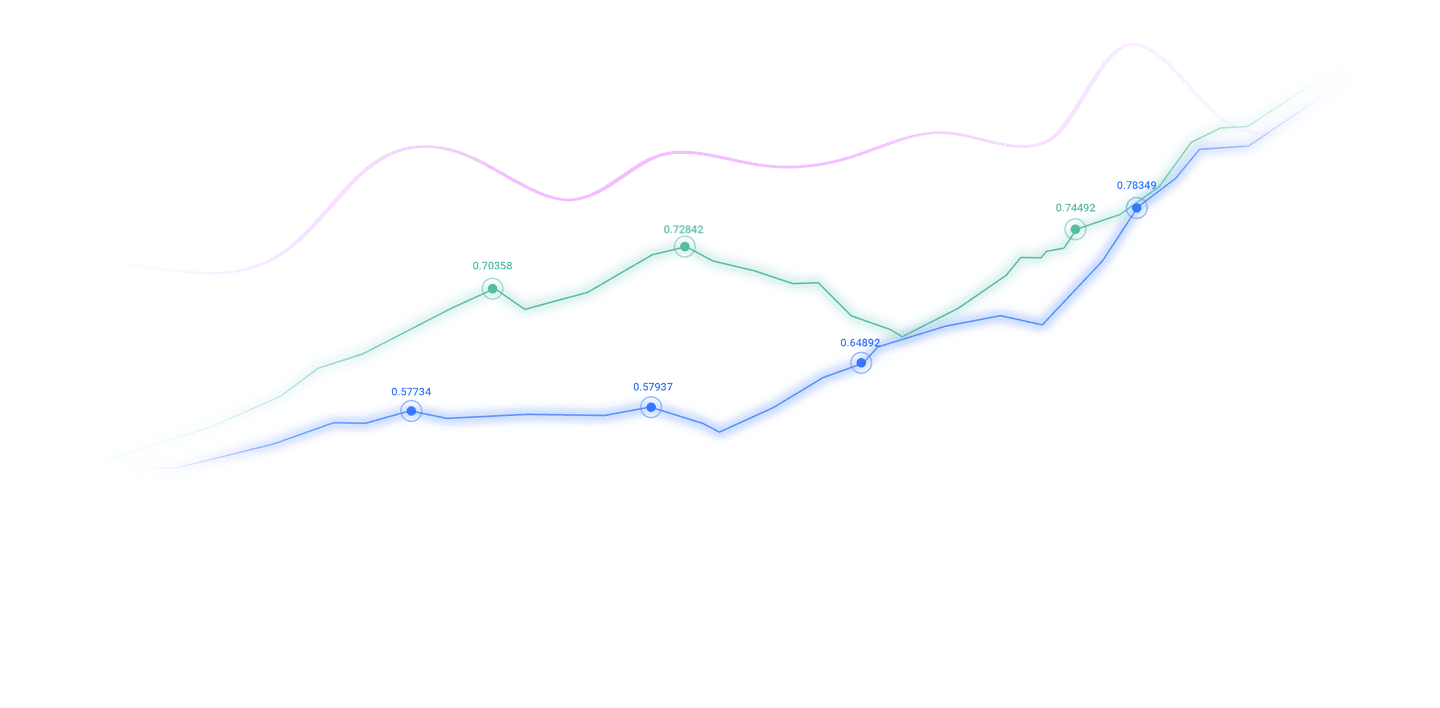

Euro/USD: As of 20:23 Beijing time, the euro/USD fell and is now at 1.1506, a drop of 0.31%. Before the New York Stock Exchange, after reaching oversold levels, leveraging the stability of key support level 1.1555, the euro-dollar gained on the last trading day, backed by positive signals on the (RSI), which prevented losses before the price recovery, although it broke the short-term major bullish trend line.

GBP/USD: As of 20:23 Beijing time, GBP/USD rose, now at 1.3352, an increase of 0.00%. Before the New York Stock Exchange, the (GBPUSD) price rose in the last intraday trading, supported by positive signals from (RSI) to reach overbought levels, indicating an end to the bullish momentum that helped it recover part of its previous losses, as negative pressure on its trading below the EMA50 continues and is under a major bearish trend in the short term.

Spot gold: As of 20:23 Beijing time, spot gold fell, now at 3323.77, a drop of 0.08%. Before New York, the (gold) price fell on the last trading day because its price exceeded the range of the bullish channel that previously supported its aggressive movement, in addition to the ongoing negative pressure caused by its trading below the EMA50, and (RSI) reached overbought levels and began to show negative overlap signals.

Spot silver: As of 20:23 Beijing time, spot silver fell and is now at 37.791, down 1.02%. Before the New York Stock Exchange, the (silver) price dominated the short-term bearish correction wave and broke through the slightly bullish trend line on a short-term basis, and the continuation of negative pressure from its trading below EMA50. In addition to negative signals on (RSI), www.xmserving.compared with the price trend, the recent negative pressure has been increased after reaching an exaggerated overbought level.

Crude Oil Market: As of 20:23 Beijing time, U.S. oil rose to 69.340, up 0.20%. Before the New York Stock Exchange, the price of (crude oil) fell on the last trading day to collect the final gains and try to get positive momentum that could help it recover and rise again, and try to get rid of the obvious overbought state on the (RSI), especially when negative signals begin to appear there, the main bullish trend dominated on a short-term basis and traded along a slash, supported by continuous trading above the EMA50, strengthening its chances of recovery.

4. Institutional View

Dutch International: If the euro zone data is not as good as the United States, the euro will face a new round of decline

Dutch International's FrancescoPesole said in a report that if the data from the euro zone and the United States show that economic growth is significantly differentiated in favor of the US dollar, the euro will face a new round of decline. France's second-quarter economic growth rate was 0.3%, stronger than expected but moderate. Germany's second-quarter growth data will be released at 16:00 Beijing time, while the U.S. second-quarter economic growth data will be released at 1230 Greenwich Time. Pesole said that if the U.S. data is stronger than the euro zone data, the euro may fall below $1.15. This is with the Netherlands International The forecast is consistent, that is, the euro weakened in the third quarter, and then rebounded to $1.18 in the fourth quarter. According to data from the London Stock Exchange Group, the euro rose 0.1% to $1.1515 on Tuesday after hitting a one-month low of $1.1515 on Tuesday, to $1.1560.

The above content is about "[XM Forex Market Review]: The euro zone is undercurrent, and the short-term trend analysis of spot gold, silver, crude oil and foreign exchange on July 30" was carefully www.xmserving.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for your support!

Share, just as simple as a gust of wind can bring refreshment, just as pure as a flower can bring fragrance. The dusty heart gradually opened, I understand sharing, sharing is actually so simple.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here