Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The Bank of England has a pigeon in the eagle. What is the warning sign behind t

- The U.S. reached several trade agreements, and the EU is ready for counter-attac

- The US dollar index is a life-and-death battle, and once the 98 is lost, it may

- Gold retreats again, life and death, long and short look at the European session

- France's political turmoil and Bank of England's position supports the pound, EU

market analysis

Risk aversion retreats from the U.S. index, gold and silver are under pressure and short-term

Wonderful introduction:

Life requires a smile. When you meet friends and relatives, smiling back can cheer up people's hearts and enhance friendship; accepting help from strangers and smiling back will make both parties feel better; give yourself a smile and life will be better!

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Market www.xmserving.commentary]: Risk aversion forced the US index to retreat, and gold and silver were under pressure to extend the short-term". Hope this helps you! The original content is as follows:

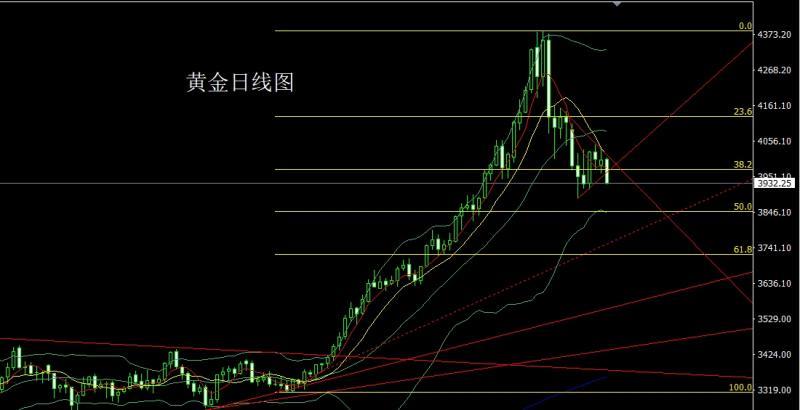

Yesterday, the gold market continued its downward pressure. After opening at 4003.1 in early trading, the market rose slightly to reach 4006.5, then fell back. After opening at 3966.1, the market rebounded. After rising, it was positioned at 4001.6 and then consolidated. During the U.S. trading session, the daily line broke the support and then fell back quickly. The daily minimum line reached the position of 3928.2 and then consolidated. The daily line finally closed at 3932.2 and then the daily line moved up and down. The big negative line with the same length of shadow line closes. After the end of this form, the daily line effectively breaks the support, and the market still needs to go short. At the point, the long of 3325 and 3322 below and the long of 3368-3370 last week are 3377 and 3. After reducing the long positions of 385 and 3563, the stop loss is followed up and held at 3750. Today, 3970 is short, and the stop loss is 3976. The lower targets are 3930 and 3923, 3915 and 3910.

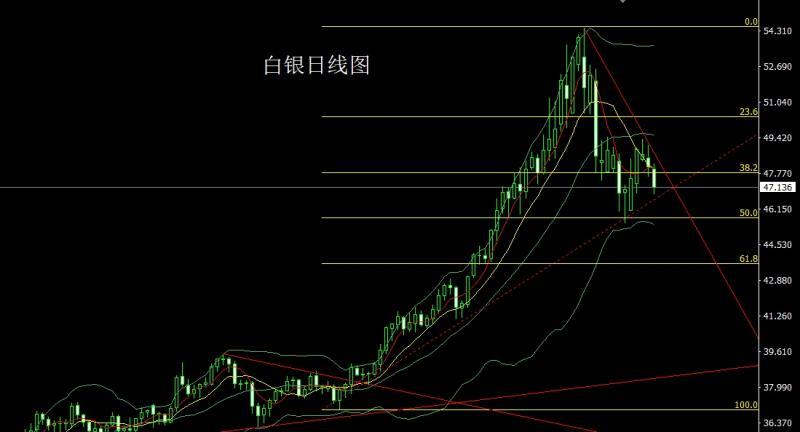

The silver market opened slightly lower yesterday at 47.994. After the market closed the gap and reached a daily high of 48.213, the market fluctuated strongly and fell back. The daily low reached a position of 46.832 and then consolidated in late trading. After the line finally closed at 47.136, the daily line closed with a big negative line with a lower shadow line slightly longer than the upper shadow line. After the end of this form, there is downward pressure today. In terms of points, the longs of 37.8 and 38.8 at the bottom follow up and are held at 42. Today, 47.6 is short. The target for stop loss below 47.8 is 47.1 and 46.8. If it falls below, the target is 46.5 and 46.3.

European and American markets opened at 1.15166 yesterday, and then the market fell first and then rose strongly to 1.14968. The highest daily line touched 1.15337 and then the market fell back strongly. The lowest daily line reached 1.14718 and then consolidated. After the daily line finally closed at 1.14818, the daily line moved up by one line. The shadow line is slightly longer than the lower shadow line and the negative line closes. After the end of this pattern, there is continued downward pressure today. In terms of point, last week's short position reduction at 1.16300 was followed by the stop loss at 1.1620. 0 1.15000 is short today, stop loss below 1.15200, target 1.14700, below 1.14500 and 1.14200.

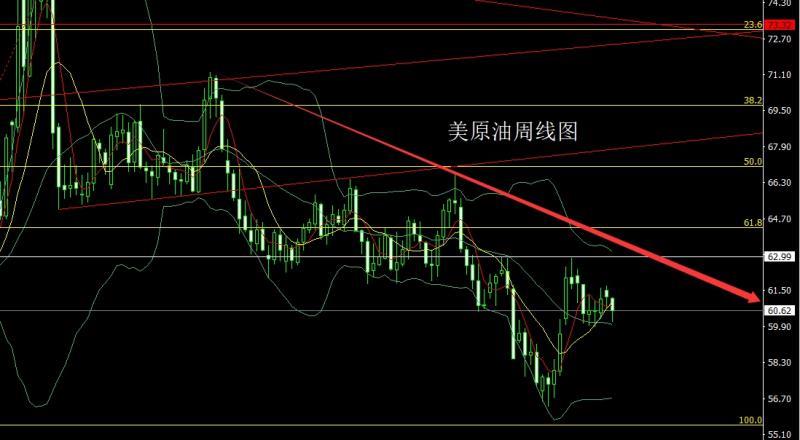

The U.S. crude oil market opened lower yesterday at 61.17, then the market rose slightly to reach a daily high of 61.2, and then the market fluctuated strongly and fell back. The daily low reached a position of 60.12, then fluctuated in a range in late trading, and the daily line finally closed. After reaching the position of 60.62, the daily line closed with a long negative line with a long lower shadow. After finishing in this form, today it will first fall back to 60.2 and stop loss 59.7, with the target of 60.8 and 61.2-61.5.

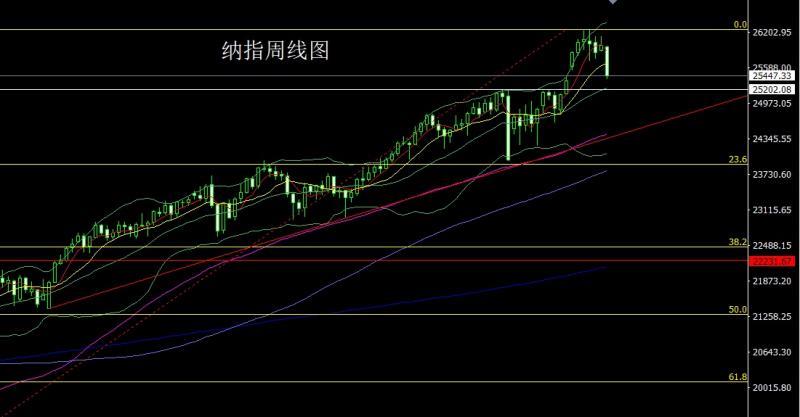

After the Nasdaq opened at 25958.48 yesterday, the market rose slightly to reach the position of 25969.69, and then the market fluctuated strongly and fell back. The daily line reached the lowest position of 25386.04 and then consolidated. After the daily line finally closed at the position of 25447.33, the daily line closed with a large negative line with the same length as the upper and lower shadow lines. And like this After the end of the pattern, today's market has continued downward pressure. In terms of points, today's 25700 short stop is 25760. The lower targets are 25500 and 25380. If it falls below, 25320 and 25300-25250.

Fundamentals: Yesterday's fundamentals: The U.S. Senate once again failed to pass the federal government's temporary appropriation bill on the 4th local time. This means that the current round of federal government "shutdown" that began on October 1 is about to break the historical record of 35 days of "shutdown" from the end of 2018 to the beginning of 2019, becoming the longest-lasting government "shutdown" in U.S. history. Cryptocurrencies also plummeted yesterday, leading to an increase in risk aversion in the market. The gold and silver markets fell back due to the sharp rise in the U.S. dollar index. Today’s fundamentals focus on the U.S. ADP employment number (10,000 people) at 21:15, and current round expectations.25,000 people, then look at the final S&P Global Services PMI for October at 22:45 and the ISM Non-Manufacturing PMI for October at 23:00. Later, look at the EIA crude oil inventories in the United States for the week to October 31 at 23:30, the EIA Cushing, Oklahoma crude oil inventories in the United States for the week until October 31, and the EIA Strategic Petroleum Reserve inventories in the United States for the week until October 31.

In terms of operation, gold: the longs of 3325 and 3322 below, the longs of 3368-3370 last week, the longs of 3377 and 3385, and the longs of 3563. After reducing positions, the stop loss is followed up and held at 3750. , 3970 short today, stop loss 3976, the lower targets are 3930 and 3923, 3915 and 3910.

Silver: The longs of 37.8 and the longs of 38.8 below follow up and hold at 42. Today, 47.6 is short. The target for stop loss below 47.8 is 47.1 and 46.8, and if it falls below, 46.5 and 46.3.

Europe and the United States: After last week's short position reduction at 1.16300, the stop loss will be followed up at 1.16200 today. The day is short at 1.15000, the stop loss is below 1.15200, the target is 1.14700, if it falls below, the target is 1.14500 and 1.14200.

U.S. crude oil: Today it fell back to 60.2 first and the stop loss is 59.7. The target is 60.8 and 61.2-61.5.

Nasdaq: 25700 today, short stop loss 25760, the lower target is 25500 and 25380, if it falls below, 25320 and 25300-252 50.

The above content is all about "[XM Foreign Exchange Market www.xmserving.commentary]: Risk aversion forced the U.S. index to retreat, gold and silver were under pressure and extended short-term". It was carefully www.xmserving.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Every successful person has a beginning. Only by having the courage to start can you find the way to success. Read the next article now!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here