Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Starting in September, gold hits a new high?

- Gold, 3400 stations are not difficult!

- Gold remained weak and fluctuated, and the rebound peaked and continued to be sh

- Guide to short-term operations of major currencies on August 11

- The dollar hovers around 98.5, and the drama "fired Powell" is updated again

market news

There is no progress in tariffs between China and the United States, and gold reaches a critical node!

Wonderful introduction:

Optimism is the line of egrets that are straight up to the blue sky, optimism is the thousands of white sails beside the sunken boat, optimism is the lush grass that blows with the wind on the head of the parrot island, optimism is the falling red spots that turn into spring mud to protect the flowers.

Hello everyone, today XM Foreign Exchange will bring you "[XM Group]: There is no progress in Sino-US tariffs, gold reaches a critical node!". Hope it will be helpful to you! The original content is as follows:

When traveling to a city, the summer vacation is over.

The last time Hefei happened 7 years ago. When the industry was at its peak, seven or eight years have passed in a flash. I have met many people these times, all of which are the stories of the past and the current ones.

The next city, August 2, Hefei, the time node is also August, and it is time for gold to be cleared.

Is it more or more? Let’s discuss it together (contact customer service to ask for the meeting address and time)!

See transactions, life, self, friends, and ultimately, they are all magic wands that break the mind!

The third round of Sino-US negotiations has ended and there is no major progress. It seems that the negotiations are not going well this time.

1, continue to maintain close www.xmserving.communication.

2. The two sides continued to promote the suspension of US reciprocal tariffs of 24%, and China's countermeasures were launched as scheduled.

This is obvious. The negotiations between the two sides were not pleasant, and the 24% suspension of tariff cycle will be www.xmserving.coming soon on August 12. The emphasis on countermeasures being carried out as scheduled means that the negotiations are very tough. If you continue to add, we will continue to add them.

The two sides will definitely talk in the future, but the EU and Japan both www.xmserving.compromise 15%. The conditions for our www.xmserving.compromise are not there, but the conditions for not adding are also necessary. This is what has been emphasized, and the tariff issue will continue.

Good morning, you in front of the screen, everything will go well, but it will be difficult to go well. Just like the Sino-US negotiations, the greatest sincerity has a good expectation and a good result, but things are contrary to your wishes and still cannot be achieved. The same is true in life. What you think may not be what society thinks, and their respective positions determine the views in different directions.

In terms of gold, low, low long, low long, four reasons, three key points:

1. The problem of tariffs will be resolved in the short term and will continue in the long term.

2. Geographical conflicts will not ease (Russia and Ukraine, Middle East)...

3. Trump's various policies benefit the United States, but the market will hedge risks and benefit gold, and the golden sentences will be frequent, and the fluctuations will have a great impact.

4. Four tests are 3400 at the top of the line. The more times you test, the smaller the resistance. If you go up, the probability of breaking the high is high.

In terms of gold, it is small positive, but whether to stop falling is the key today.

1, it will appear to swallow Yang.

2. If it is to be continuous, it cannot be suppressed by a single positive to break the bottom, so the adjustment will continue.

According to the attitude of the end of Sino-US negotiations in the morning, today, it is estimated that the United States will make a statement when it www.xmserving.comes to the US market.

For technical aspects, yesterday there was a typical volatile correction.

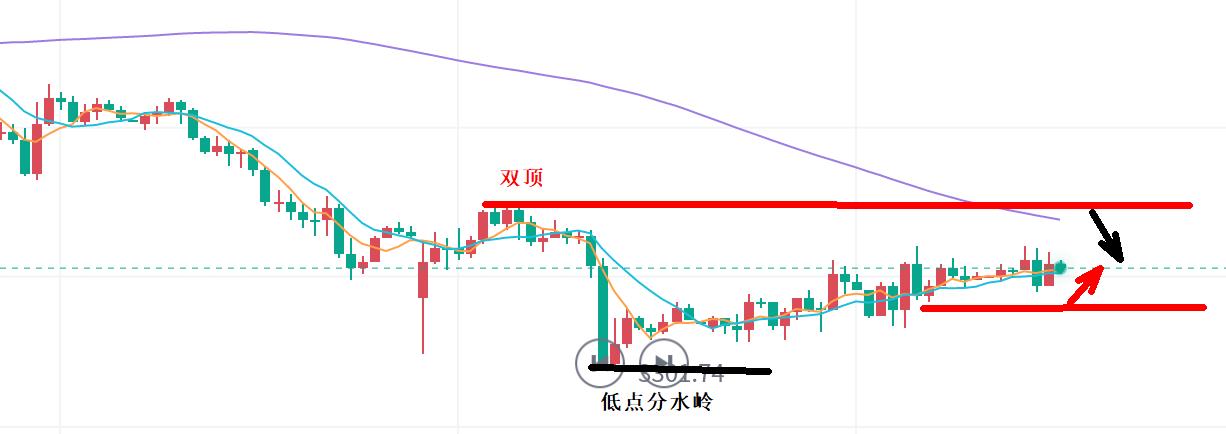

1, it touched 3330 and retreated within the day, and the 618 position and the hourly line were at the top of the big negative. The European session rebound felt that it was good, but it was a single positive rebound and the US session retreated before the session.

2,3311, this is yesterday's low rebound at 3330 and retreated 618. The US market did not continue to decline, but instead supported the rebound.

3. The hourly line does not continue, whether it is a decline or a rise, and it repeats over and over again. This is also a sign of oscillation, in terms of K-line.

Today is at the key node, one is to see whether the adjustment continues, and the other is to stop the decline.

The bottoming out and rebounded in the morning, but it still did not continue, especially the 4-hour small positive step, and the rise was still difficult.

Then the European session is the key, and the strength of the European session is related to the overall market.

1, the watershed below is still 3301, and if it breaks, it will continue to adjust.

2, the double top position above is 3345, and the double top position during oscillation still depends on the resistance.

3. The Sino-US negotiations have not been reached, and the European session is resistant to declines, and the US session still needs to be more focused on the 3318-9 line.

The longer the time point of short-term oscillation, the faster the trend will be. In terms of rhythm, just keep it low. The logic remains unchanged, it's just torment in the middle.

(Detailed strategies, follow member tips)

[The above only represents the author's personal views and opinions. Investment is risky, so be cautious when entering the market]

The above content is all about "[XM Group]: There is no progress in Sino-US tariffs, gold reaches a critical node!". It was carefully www.xmserving.compiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your transactions! Thanks for the support!

After doing something, there will always be experience and lessons. In order to facilitate future work, we must analyze, study, summarize and concentrate the experience and lessons of previous work, and raise it to the theoretical level to understand it.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here