Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- U.S. oil is expected to test $60 per barrel, Fed's interest rate cuts in Septemb

- Is gold really going to fall again?

- Continue to go down, 3359 is the key to long and short!

- The latest trend analysis of the US dollar index, yen, euro, pound, Australian d

- Guide to short-term operation of major currencies on August 1

market analysis

A collection of positive and negative news that affects the foreign exchange market

Wonderful Introduction:

I missed more in life than not, and everyone has missed countless times. So we don’t have to apologize for our misses, we should be happy for our own possession. Missing beauty, you have health: Missing health, you have wisdom; missing wisdom, you have kindness; missing kindness, you have wealth; missing wealth, you have www.xmserving.comfort; missing www.xmserving.comfort, you have freedom; missing freedom, you have personality...

Hello everyone, today XM Foreign Exchange will bring you "【XM Foreign Exchange Market Analysis】: Collection of positive and negative news that affects the foreign exchange market". Hope it will be helpful to you! The original content is as follows:

Domestic economic data and policies send out positive signals

Recently, domestic economic data has shown a positive trend, injecting positive factors into the foreign exchange market. A series of data released by the National Bureau of Statistics showed that the GDP in the first half of the year increased by 5.3% year-on-year, and the economic structure continued to be optimized. Especially in the second quarter, the contribution of domestic demand such as final consumption and total capital formation to economic growth has increased significantly to 77%, an increase of 17 percentage points month-on-month. The strong performance of domestic demand has strengthened the market's confidence in RMB assets, attracted foreign capital inflows, and supported the RMB exchange rate.

The State Administration of Foreign Exchange is also making efforts on the policy end. On July 22, Li Bin, deputy director of the State Administration of Foreign Exchange, said at a press conference of the State Information Office that he would continue to promote the facilitation of cross-border trade and investment and financing. For example, the "Kehuitong" pilot program will be promoted nationwide to facilitate scientific research institutions to receive overseas funds and promote international scientific research cooperation; the amount of science and technology innovation enterprises to borrow foreign debt independently, and some high-quality enterprises will be increased to US$20 million, helping science and technology innovation enterprises to broaden financing channels. These policies will help attract more foreign capital to the domestic market, increase the demand for RMB in the foreign exchange market, and form potential support for the RMB exchange rate.

The international economic and trade situation affects the long-short game of the foreign exchange market

The news that the United States and Europe reached a trade agreement and the extension of the tariff exemption period between China and the United States has a far-reaching impact on the global foreign exchange market. This positive economic and trade signal has enhanced the market risk appetite, and funds flow out of safe-haven assets and flow into risky assets. The demand for safe-haven assets for the US dollar hassuppressed. The US dollar index has been weak recently. In the first six months of 2025, the ICE US dollar index fell by nearly 11%, the largest drop in the first half of the year since the Nixon era in 1973. The easing of the trade situation has led to improved market expectations for global economic growth prospects, and non-US currencies generally receive certain support.

However, there is still uncertainty in U.S. tariff policy. Despite the current positive news on trade, the aftermath of the Trump administration's previous tariff measures on the global economic order has not yet subsided. The market is concerned that tariff policies will change again in the future, and this uncertainty limits the gains of non-U.S. currencies. Moreover, the performance of US economic data still has an important impact on the US dollar. If the subsequent US economic data is stronger than expected, it may reverse the weakness of the US dollar and have a new impact on the long and short pattern of the foreign exchange market.

The differentiation of monetary policies of global central banks has intensified exchange rate fluctuations

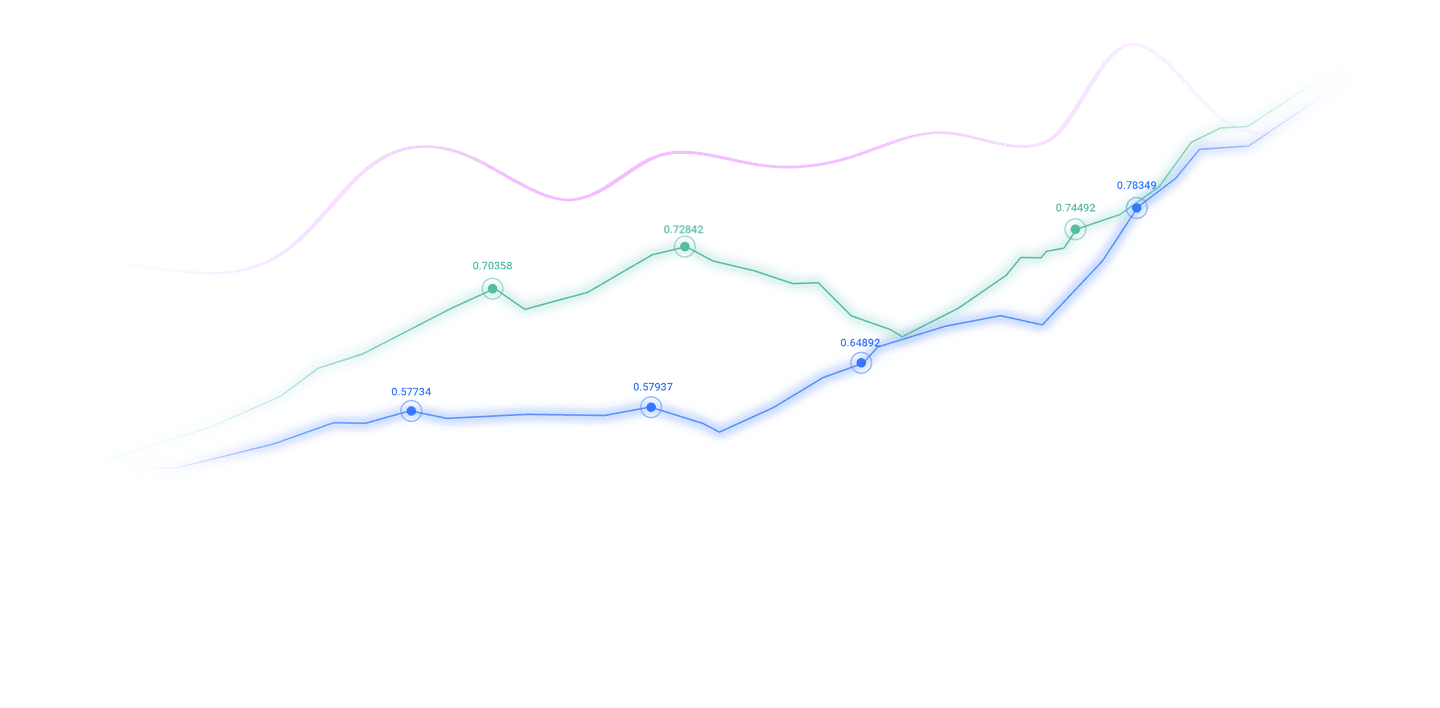

The differentiation of monetary policies of major global central banks is a key factor affecting the foreign exchange market. The Fed's interest rate meeting became the market focus this week. The market is currently generally expected that the Fed may cut interest rates in September, and the Chicago Mercantile Exchange (CME) Fed observation tool shows this expectation. The Fed's expectation of interest rate cuts has reduced the attractiveness of US dollar assets, pushing the dollar to weaken. In contrast, some other central banks may tend to tighten their existing monetary policies. For example, the Bank of England maintained strong expectations of high interest rates due to factors such as domestic inflation data, which widened the spread advantage of the pound over currencies such as the euro, supporting the pound exchange rate.

For the European Central Bank, although it maintained loose monetary policy, the euro zone economic data performed poorly, such as the July economic prosperity index was lower than expected. The unfavorable terms faced by the EU in the US-EU trade agreement, such as the purchase of US energy at high prices, have also cast a shadow on the economic outlook of the euro zone and suppressed the euro exchange rate. The differentiation of monetary policies of different central banks has led to intensifying exchange rate fluctuations among currencies. Investors need to pay close attention to the policy trends of central banks in various countries and related economic data to seize investment opportunities in the foreign exchange market.

Overall, on July 29, 2025, the foreign exchange market was affected by the interweaving of positive news on many aspects and negative news. The positive side of domestic economic data and policies provides support for the RMB. The easing of the international economic and trade situation is beneficial to non-US currencies, but there is still uncertainty. The differentiation of monetary policy of global central banks has intensified exchange rate fluctuations. Investors need to consider these factors www.xmserving.comprehensively when trading and formulate trading strategies with caution.

The above content is all about "【XM Foreign Exchange Market Analysis】: Collection of Positive and Negative News that Influence the Foreign Exchange Market". It was carefully www.xmserving.compiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Spring, summer, autumn and winter, every season is a beautiful scenery, and it stays in my heart forever. Leave~~~

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here