Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Multiple data bearish US dollar, gold prices fall below two-week high intraday t

- The ECB rate cut is postponed until next year! Today's CPI is difficult to chang

- The dollar index consolidates around 98, traders wait for more Fed rate cut sign

- A collection of positive and negative news that affects the foreign exchange mar

- Trade deal eases concerns, euro maintains high fluctuations against the dollar

market analysis

Expectations of a rate cut by the Federal Reserve subside, the U.S. dollar index breaks through 100, and the market awaits U.S. ADP data

Wonderful introduction:

Life is full of dangers and traps, but I will never be afraid anymore. I will remember it forever. Be a strong person. Let "Strength" set sail for me and accompany me to the other side of life forever.

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Decision Analysis]: The Fed's interest rate cut expectations have faded, the U.S. dollar index has exceeded 100, and the market is waiting for U.S. ADP data." Hope this helps you! The original content is as follows:

In Asian trading on Wednesday, the U.S. dollar index fluctuated above the 100 mark. The strength of the U.S. dollar still benefits from strong economic data and cautious remarks from Federal Reserve officials. These factors make investors uncertain about the timing of the next interest rate cut. Looking ahead, traders will keep a close eye on Wednesday's upcoming ADP employment changes and ISM Services Purchasing Managers' Index (PMI) reports for new clues on the U.S. labor market and services sector activity. The importance of private sector indicators has increased as the government shutdown has delayed the release of official data. The ADP report may provide early insights into hiring momentum and broader labor market trends. In the Eurozone, attention will turn to the HCOB Services PMI and September Producer Price Index (PPI).

Analysis of major currency trends

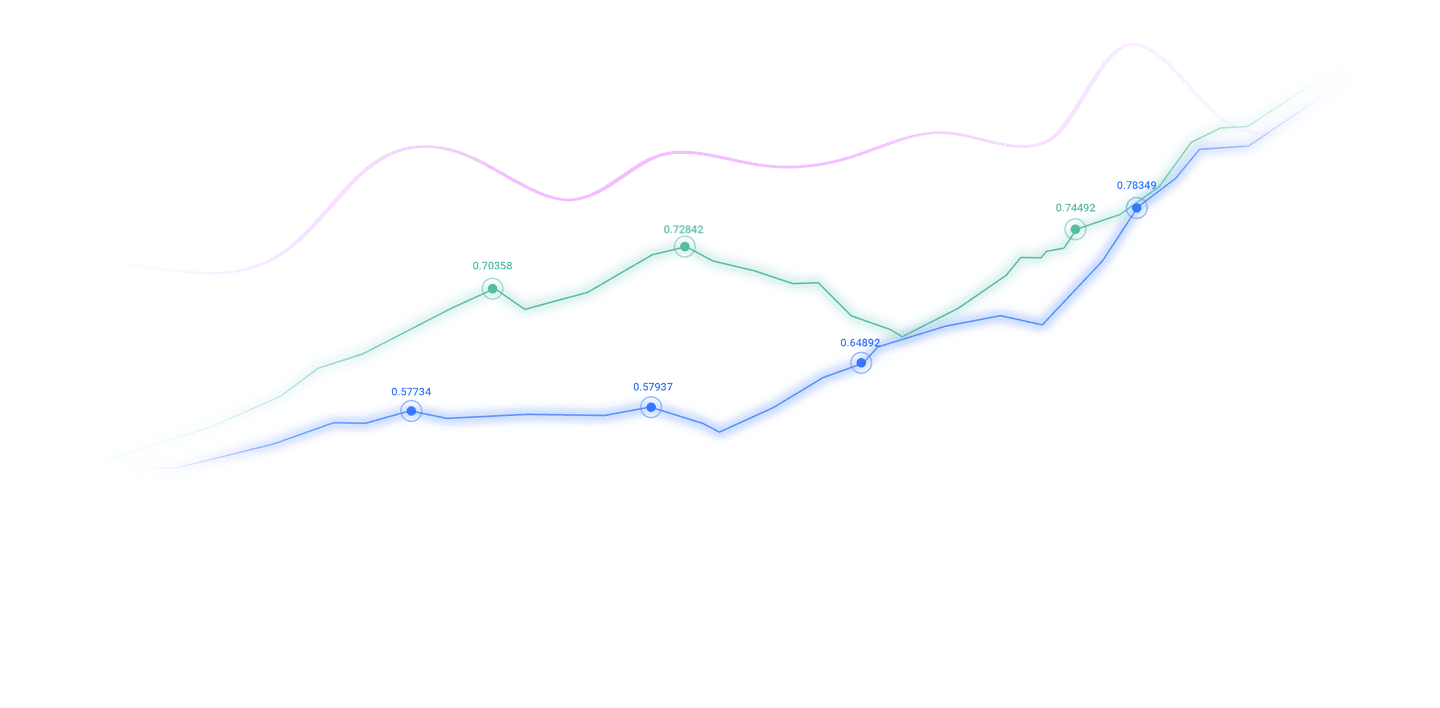

U.S. dollar: As of press time, the U.S. dollar index is hovering around 100.17. The rise of the U.S. dollar is due to the weakening of expectations for an interest rate cut in December. After the Federal Reserve cut interest rates last week, Chairman Jerome Powell said there would not necessarily be another rate cut in December. Traders have adjusted accordingly, with CME's FedWatch tool now showing a 65% chance of a rate cut in December, down sharply from 94% a week ago. The dollar's near-term outlook remains cautiously bullish, supported by falling expectations for a December Fed rate cut and continued demand for safe-haven assets. The CME FedWatch Tool now shows only a 65% chance of another rate cut, www.xmserving.compared with 94% a week ago, and traders are reassessing U.S. dollar exposure, favoring holding the greenback during policy uncertainty. At the same time, global risk sentiment remains fragile, with stock markets under pressure and demand for defensive assets rising, further consolidating the U.S. dollarbasic strength. Technically, the relative strength index (RSI) is at 62, indicating neutral momentum, but the slight pullback suggests demand is cooling after the recent rebound. The immediate support level is around 99.41. If the correction deepens, the next support level at 99.14 may attract buyers to re-enter the market. If the price can clearly close above 100.05, it will open up space to test the 100.35–100.63 range; while if it falls below 99.40, it may shift short-term sentiment towards the 98.90 support level.

1. The Fed’s disagreements cast a shadow on interest rate cut expectations

The rise of the US dollar benefited from the weakening of expectations for an interest rate cut in December. After the Federal Reserve cut interest rates last week, Chairman Jerome Powell said there would not necessarily be another rate cut in December. Traders have adjusted accordingly, with CME's FedWatch tool now showing a 65% chance of a rate cut in December, down sharply from 94% a week ago. The ongoing government shutdown has suspended the release of official economic data, leaving investors to rely on private data. U.S. factory activity contracted for an eighth straight month, the Institute for Supply Management (ISM) manufacturing survey showed on Monday, underscoring underlying weakness. Still, with no clear policy signals and limited data, the dollar continues to benefit from safe-haven flows and reduced interest rate cut expectations.

2. The U.S. government shutdown will be record-breaking

On November 4, local time, the U.S. Senate once again failed to advance a temporary federal government funding bill that had been passed by the House of Representatives and proposed by the Republican Party. This means that the current round of federal government "shutdown" that began on October 1 is about to break the historical record of 35 days of "shutdown" from the end of 2018 to the beginning of 2019, becoming the longest-lasting government "shutdown" in U.S. history. The vote that day once again failed to reach the 60 "threshold" required for passage, and the final vote was 54 in favor and 44 against. Three Democratic senators voted in favor and one Republican senator voted against. This is also the 14th time the Senate has failed to end the government shutdown.

3. Poll: More than half of the American people believe that tariffs have exacerbated household financial pressures

On November 4, local time, a latest poll showed that a majority of the American people believe that the high tariff policy implemented by the Trump administration has harmed people’s household financial conditions and pushed up inflation. The survey results show that about 70% of Americans said that www.xmserving.compared with last year, they spent more on groceries; 60% said that utility bills increased; and 40% said that medical, housing and automobile expenses increased.Fuel costs are higher. Overall, 55% of respondents believe that tariff policies have worsened household financial conditions. More than 60% of the respondents believe that tariffs will push up inflation in the United States and harm the economy of their own country and the countries being taxed.

4. The British Chancellor’s speech increases the possibility of an unexpected interest rate cut by the Bank of England

The Bank of England is expected to keep interest rates unchanged at 4.0% in Thursday’s resolution, but the latest speech by Finance Minister Reeves has increased the possibility of an unexpected interest rate cut. LSEG data shows that money markets now expect the probability of a UK interest rate cut this week to be close to 35%, up from 30% on Monday. Reeves said the measures in the budget would reduce both debt and inflation, meaning an income tax hike was more likely. Institutional analysts pointed out that recent data showed that inflationary pressures have eased, coupled with rising market expectations that Reeves may further raise taxes, making an interest rate cut this week more likely.

5. Moody's: The Reserve Bank of Australia is expected to remain on the sidelines and may not cut interest rates until mid-2026 at the earliest

Moody's Analysis said that in view of the Reserve Bank of Australia's increasing concerns about inflation risks, the possibility of interest rate cuts in December and February next year has been ruled out. An interest rate cut may not occur until mid-2026 at the earliest, and this still depends on the economic situation. Sunny Kim Nguyen, the agency's director of Australian economics, pointed out: "Before the RBA acts again, it must see a convincing decline in inflation, a real decline, not just a predicted decline." Analysts said that considering the political and www.xmserving.communication costs of policy reversal, it is almost impossible for the RBA to raise interest rates again. She believes that the Reserve Bank of Australia will maintain a wait-and-see stance, hoping that "private demand will cool down on its own and productivity will improve."

Institutional perspective

1. People's livelihood macro: The U.S. dollar index breaks through 100 again but the appreciation cycle has not yet arrived

The Minsheng Macro Research Report stated that we tend to believe that the current breakthrough of the US dollar index will be more "successful" www.xmserving.compared to July - the rebound point may be higher (101 to 103) and last longer. At least after the US government opens its doors, continuous weak economic hard data will be needed to revise market expectations. However, we do not believe that the appreciation cycle of the US dollar is www.xmserving.coming. The current US dollar is more of a rebound: in the short term, the market has begun to price in no interest rate cut in December (the expected probability has exceeded 30%), which leaves more room for subsequent adjustments in policy expectations. In addition, the White House will announce the candidate for the chairman of the Federal Reserve before the end of the year. Judging from the popular candidates, the difference in policy is only "easy" or "extremely easy", which is not expected to be good news for the US dollar.

2. Mitsubishi UFJ: Further interest rate cuts by the Bank of England will weaken the pound. The euro is expected to rise to 0.89 in the first quarter of next year.

Analysts at Mitsubishi UFJ said in a report that if the Bank of England cuts interest rates in December, there may be room for further depreciation of the pound. They pointed out that upcoming data may confirm that inflation has peaked. In addition, the November 26 budget is expected to include tax increases to ensure fiscalRules are being followed, which may also provide room for rate cuts. LSEG data shows that the market currently expects a 66% probability of a UK interest rate cut in December. Analysts say this will add to the downside in short-term yields, causing sterling to continue to underperform. Mitsubishi UFJ expects EUR/GBP to rise to 0.8900 in the first quarter of 2026 and to 0.9000 in the second quarter.

3. Mitsubishi UFJ: Good economic fundamentals in the euro zone will support the rebound of the euro

Analysts at Mitsubishi UFJ said in a report that the euro is expected to rebound because the good economic fundamentals in the euro zone do not support further interest rate cuts by the European Central Bank. They pointed out that the macroeconomic environment is generally favorable and this trend is expected to continue. The European Central Bank highlighted last week that negative risks to economic growth had declined due to easing trade uncertainty and a ceasefire in Gaza. "We now expect the European Central Bank to keep interest rates unchanged until June next year, while at the same time we expect the Federal Reserve to begin aggressive interest rate cuts," the report said. Bank of Mitsubishi UFJ expects EUR/USD to rise to 1.20 in the fourth quarter of this year and to 1.26 in the third quarter of 2026.

The above content is all about "[XM Foreign Exchange Decision Analysis]: The Fed's interest rate cut expectations have faded, the U.S. dollar index has exceeded 100, and the market is waiting for the U.S. ADP data". It was carefully www.xmserving.compiled and edited by the XM foreign exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Sharing is as simple as a gust of wind can bring refreshing, as pure as a flower can bring fragrance. Gradually my dusty heart opened up, and I understood that sharing is actually as simple as the technology.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here