Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Analysis】--BTC/USD Forex Signal: Bitcoin Analysis as Doji, Wedge Form

- 【XM Group】--USD/CAD Forecast: Awaits Jobs Data

- 【XM Group】--Coffee Weekly Forecast: Calmer Prices Seen and Potential Trading Tra

- 【XM Market Analysis】--USD/CHF Forecast: US Dollar Rallies from Support Against S

- 【XM Decision Analysis】--CAD/CHF Forecast: Rallies Strongly Against Swiss Franc

market analysis

The Bank of England expects to keep interest rates unchanged, and short-term trend analysis of spot gold, silver, crude oil and foreign exchange on June 13

Wonderful Introduction:

The moon has phases, people have joys and sorrows, whether life has changes, the year has four seasons, after the long night, you can see dawn, suffer pain, you can have happiness, endure the cold winter, you don’t need to lie down, and after all the cold plums, you can look forward to the New Year.

Hello everyone, today XM Foreign Exchange will bring you "[XM Official Website]: The Bank of England is expected to maintain interest rates unchanged, and the short-term trend analysis of spot gold, silver, crude oil and foreign exchange on June 13". Hope it will be helpful to you! The original content is as follows:

Global Market Review

1. European and American market trends

The three major U.S. stock index futures fell, Dow futures fell 1.04%, S&P 500 futures fell 1.01%, and Nasdaq futures fell 1.26%. The German DAX index fell 1.46%, the UK FTSE 100 index fell 0.31%, the French CAC40 index fell 0.94%, and the European Stoke 50 index fell 1.24%.

2. Market news interpretation

The Bank of England expects to keep interest rates unchanged, despite the slowdown in the employment market

⑴ The Bank of England expects to maintain the benchmark interest rate at 4.25% at its June 19 meeting, continuing its gradual path to cut interest rates. ⑵ Slower wage growth may not be enough to speed up interest rate cuts, as policymakers remain concerned about the impact of inflation and tariffs on economic growth. ⑶ Almost all economists and markets expect the Bank of England to cut interest rates next in August and cut it again before the end of the year to 3.75%. ⑷ Since August 2024, the Bank of England has cut interest rates only once every quarter, with a total of four cuts due to continued inflationary pressures and wage growth. ⑸ The Monetary Policy www.xmserving.committee in May lowered the interest rate from 4.5% to 4.25% with a 5-4 vote, and the decision-making differences were large. ⑹ Weaker labor market data this week helped restore market expectations that the Bank of England will continue to cut interest rates on a quarterly basis, although increased employment taxes and minimum wages pushed up labor costs in April. ⑺UK wage growth slowed to more than 5% in April, still higher than the www.xmserving.comfort level of the Bank of England, with the number of www.xmserving.company employees falling in May and the unemployment rate rising to 2021The highest level since the year. ⑻The UK National Statistics Office reported that consumer price inflation rose to 3.5% in April from 2.6% in March, but was subsequently revised to 3.4%. ⑼ Financial markets are currently expected to cut interest rates twice, at 25 basis points each, a slight decline after Israel launched a large-scale military strike against Iran. ⑽The Bank of England's interest rate cuts are much slower than the European Central Bank, which has cut interest rates by 2 percentage points since June 2024.

Trump said he had no choice but would not fire him

On June 12, local time, US President Trump once again "pressed" US Federal Reserve Chairman Powell at an event at the White House, demanding that the Federal Reserve cut interest rates as soon as possible, preferably 1 percentage point, or even higher. Trump said that considering the US debt, as long as the Fed cuts interest rates, the US can pay a lot of interest less - for example, if the Fed cuts interest rates by 1 percentage point, the US can pay $300 billion in debt less interest every year. However, Trump also admitted that he "can't do anything to Powell" but he would not "fire him." Trump has criticized Powell many times this year and threatened to fire his Fed chairmanship. Powell said Trump, as president, has no legal authority to remove him from his post and he will work until the end of his term.

The EU calls on all parties in the Middle East to maintain restraint

⑴ EU leaders called on all parties in the Middle East to maintain restraint on June 13. ⑵ European www.xmserving.commission President Ursula von der Leyen said: "The report from the Middle East is deeply worrying. Europe urges all parties to maintain maximum restraint, immediately downgrade the conflict and avoid retaliation. A diplomatic resolution is more urgent than ever." ⑶ EU foreign policy head Kaja Karas said in a statement: "Diplomatic is still the best way, and I am ready to support any diplomatic efforts aimed at downgrading the conflict." ⑷ European Council President Antonio Costa also called on all parties to maintain restraint. The European Council represents the national governments of the 27 EU member states.

The Japanese Finance Minister said dialogue with the market is the key to ensuring bond issuance

As the upcoming meeting with investors, the Japanese Finance Minister said that www.xmserving.communicating with market participants is the key to ensuring stable trading of government bonds. “We are having a thoughtful and cautious dialogue with the market and it is our responsibility to ensure that government bonds can be purchased,” Finance Secretary Katsushiro Kato said Friday. He said the government needs to find other investors to fill the gap as the Bank of Japan reduces its bond purchases.

The Israeli army continues to attack Iran. The spokesperson of the Israeli army: Preparing for Iran's response

Israeli Defense Force spokesman Efe de Flynn said at a press conference on the 13th local time that the Israeli Air Force is continuing to attack Iran. He said that the Israeli army is currently continuing to implement the attack plan "to achieve the target of action and defend Israel." Asked when Iran is expected to launch ballistic missiles at Israel, Deflyn said “the operation has just begun”, adding that the military is “for Iran”Lang's response is ready.

The EU will require the disclosure of details of Russian gas transactions

⑴ European www.xmserving.commission documents show that the EU will force www.xmserving.companies to disclose detailed information on Russian gas transactions, including contract term, annual contract volume, destination terms and signing date, etc. ⑵ The EU www.xmserving.commission plans to www.xmserving.completely stop importing natural gas from Russia by the end of 2027 and ban new Russian gas transactions by the end of this year. ⑶ From January 1, 2026, the EU will ban liquefied natural gas terminals from providing services to Russian customers, but according to the short-term supply agreement, the deadline for existing service contracts will be extended to June 17, 2026. ⑷ From December 31, 2027, the EU will ban liquefied natural gas terminals Provide long-term contract services to Russian customers. ⑸ The proposal will be announced on June 17, 2025, aiming to promote the EU to get rid of its dependence on Russian natural gas.

Israel closes the largest natural gas field, affecting regional supply

⑴ Israeli Ministry of Energy ordered the temporary closure of Leviathan, the country's largest natural gas field, mainly for security reasons. Iran promised retaliation after Israel launched an attack on Iran. ⑵ The closure of Leviathan gas fields mainly affects the supply of natural gas to Egypt, which may force Egypt to purchase liquefied natural gas in advance, thereby further tightening the global market. ⑶ European natural gas prices have risen by 6.6%. ⑷ Leviathan gas fields are operated by Chevron to supply natural gas to domestic Israeli customers and neighboring countries such as Jordan and Egypt . ⑸ It is not clear whether another oil field operated by Chevron has also been suspended.

EU employment rate and labor idle situation in the first quarter of 2025

⑴In the first quarter of 2025, the employment rate of the 20-64-year-old population aged 76.1%, an increase from 76.0% in the fourth quarter of 2024. ⑵The labor idle rate (all unmet employment needs, including unemployed people) accounts for 10.9% of the 20-64-year-old labor force, up 0.1 percentage point from the fourth quarter of 2024. ⑶Ireland (+0.9 percentage points), Italy (+0.7 percentage points), Hungary, Sweden, Greece and Portugal (+0.4 percentage points each) are 17 EU employment rates. The largest increase among allied countries. ⑷The employment rates in Germany, Luxembourg and the Netherlands remained stable, while the employment rates in seven EU countries fell, among which Estonia (-0.5 percentage points), Romania and Poland (-0.4 percentage points each) and Lithuania (-0.3 percentage points) fell the most.

Mossad infiltrated Iran in advance of secret deployment

According to Israeli security sources, before the Israeli military launched an air strike on Iran in the early morning of today (June 13), the Israeli Intelligence and Secret Service, the www.xmserving.commando of the "Mossad" had carried out a series of secret operations in the depths of Iran. The source said that in addition to surveillance of senior Iranian officials and nuclear scientists, the "Mossad" www.xmserving.commando also tookSecret operations aimed at weakening Iran's strategic missile system include: deploying precision-guided weapons in open areas near Iran's surface-to-air missile system positions, establishing attack drone bases near Tehran, and transporting advanced vehicle-mounted attack systems into Iran to attack Iran's air defense systems.

Tensions in Iran and Israel have increased, with some flights cancelled, delayed and diverted.

Several major international airlines, including Emirates, Etihad Airways, Qatar Airways, Air India and Lufthansa, have canceled, postponed and changed flights after Israel attacked Iran on Friday morning. Etihad Airways canceled flights to and from Tel Aviv, and Emirates also canceled flights to and from Iraq, Jordan, Lebanon and Iran. Qatar Airways suspended flights to Iran and Iraq. Air India said several flights have been diverted or returned, and Lufthansa has suspended flights to Iran. Syrian Airlines announced in a statement Friday that it suspended flights to the UAE and Saudi Arabia today after Iraq and Jordan airspace closed. Syria has not announced a www.xmserving.complete closure of its airspace. Syrian Airlines said it was "strickenly watching the situation." Iran also announced the closure of airspace, and Tel Aviv's Ben Gurion Airport is closed, pending further notice. Israel's ElAl Airlines and Israel Airlines evacuated the planes from Tel Aviv earlier.

3. Trends of major currency pairs in the New York Stock Exchange before the New York Stock Exchange

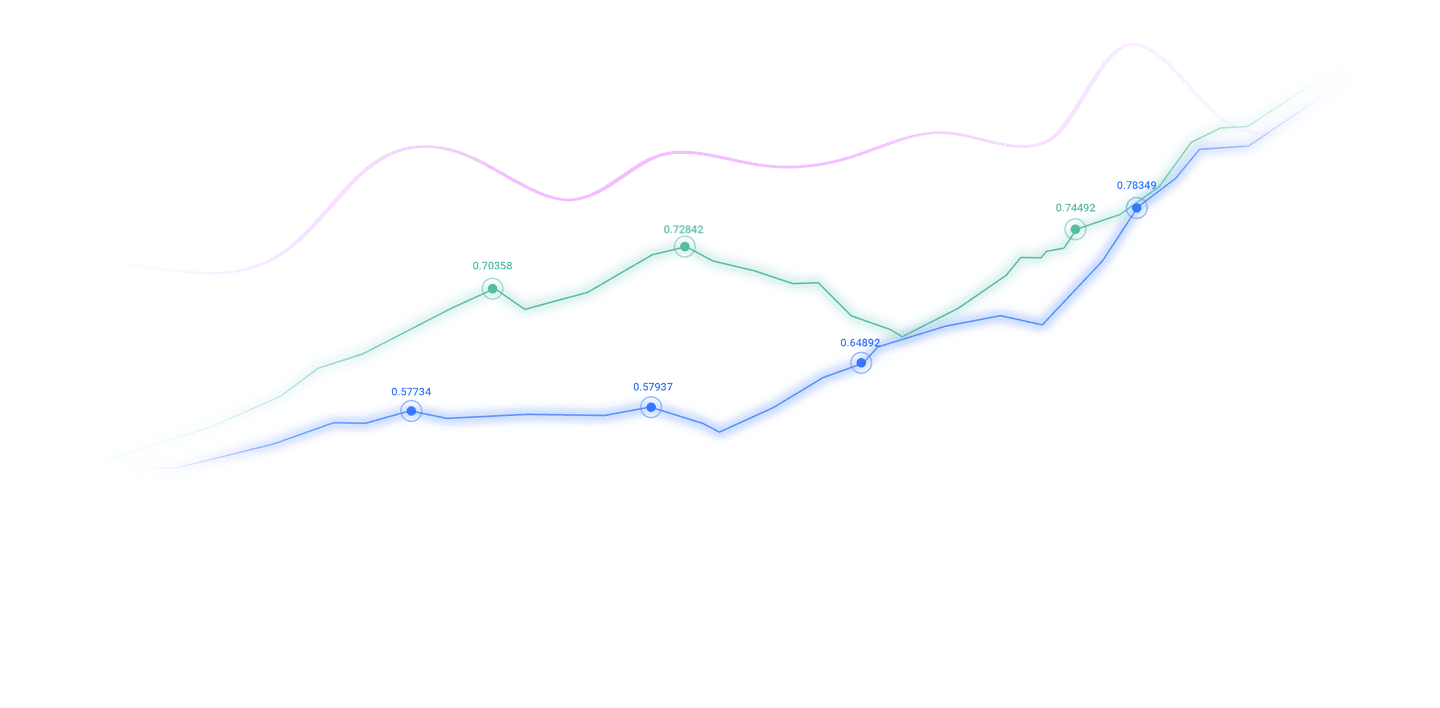

Euro/USD: As of 20:20 Beijing time, the euro/USD fell and is now at 1.1515, a drop of 0.60%. Before the New York Stock Market, the price of (EUR/USD) fell at the recent intraday level, trying to find a higher low, based on this, may help it get the desired positive momentum and rise again, continuing the main bullish trend on a short-term basis and trading along a slash, noting that (RSI) reaches oversold levels, which suggests that they are beginning to show a positive divergence.

GBP/USD: As of 20:20 Beijing time, GBP/USD fell and is now at 1.3535, a drop of 0.57%. Before the New York Stock Exchange, after failing to break through the key resistance of 1.3600, the GBPUSD price fell sharply on the last trading day, trying to get the bullish momentum needed to break through that resistance and trying to get rid of some obvious overbought situations on the (RSI) indicators, especially in the case of negative signals on these indicators. The pair is approaching from support that relies on EMA50, which represents a positive support for the last period.

Spot gold: As of 20:20 Beijing time, spot gold rose, now at 3423.69, an increase of 1.10%. Before the New York Stock Exchange, the (gold) price fluctuated in the last trading day, affected by the current resistance stabilized at $3,435, trying to obtain positive momentum that could help break through this level and trying to unload some obvious overbought conditions on the (RSI), especially as negative signals emerge, bullish correction trends on a short-term basis dominate and trade along a slash.

Spot silver: As of 20:20 Beijing time, spot silver fell, now at 36.263, a drop of 0.18%. Before the New York Stock Market, after reaching overbought levels, the (silver) price fell on the last trading day with negative signals on the (RSI), trying to unload some overbought levels, which allowed it to recover and rise again, and the positive pressure from trading above its EMA50 continues to exist, representing a dynamic support for maintaining the enthusiasm of the price movement, while the short-term major bullish trend continues to exist and trade along a slash.

Crude oil market: As of 20:20 Beijing time, U.S. oil rose, now at 73.680, an increase of 8.25%. Before the New York Stock Exchange, the (crude oil) price rose slightly in recent intraday trading, after attacking the $74.50 resistance level, but it rebounded quickly to collect its earnings in an attempt to gain positive momentum that could help breakouts, dominating the main bullish trend in the short term and trading along the main and secondary slashes, on the other hand, we noticed the emergence of negative signals on (RSI), which slowed the rise.

4. Institutional View

Rabobank: The risk of escalating the situation in the Middle East is underestimated

⑴ Philip Marey, senior US strategist at Rabobank, pointed out that although investors expect the conflict between Israel and Iran to remain limited, the risk of escalating the situation in the Middle East is quite high. ⑵Israeli Prime Minister Netanyahu said that military operations will continue until the threat is eliminated, and Iran also threatens to attack U.S. military assets in the region. ⑶ The market seems to have digested the best situation, short-term rapid action, and the worst case is the long-term war spreading to the Strait of Hormuz or Gulf countries.

The above content is all about "[XM official website]: The Bank of England expects to keep interest rates unchanged, and the short-term trend analysis of spot gold, silver, crude oil and foreign exchange on June 13" was carefully www.xmserving.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Due to the author's limited ability and time urgency, etc.Some content in the article still needs to be discussed and studied in depth. Therefore, in the future, the author will conduct extended research and discussion on the following issues:

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here