Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Forex】--Dax Forecast: Sees Overhang of Resistance

- 【XM Decision Analysis】--GBP/USD Forecast: Consolidates in Range

- 【XM Forex】--EUR/USD Analysis: Bearish Dominance May Strengthen

- 【XM Decision Analysis】--USD/JPY Analysis: Awaiting New Buying Opportunities

- 【XM Group】--AUD/USD Forex Signal: Not Much Direction

market analysis

The Middle East will further promote risk aversion, and gold and silver will benefit from low

Wonderful introduction:

Spring flowers will bloom! If you have ever experienced winter, then you will have spring! If you have dreams, then spring will definitely not be far away; if you are giving, then one day you will have flowers blooming in the garden.

Hello everyone, today XM Foreign Exchange will bring you "[XM official website]: The Middle East will promote risk aversion again, and gold and silver will benefit from low-limits." Hope it will be helpful to you! The original content is as follows:

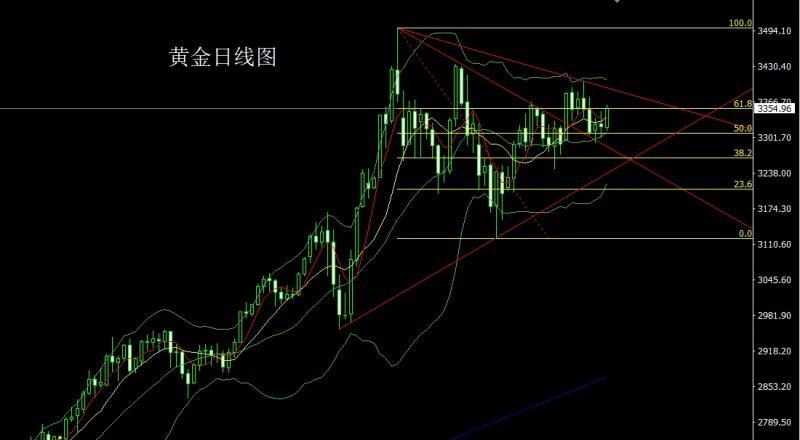

The gold market fluctuated yesterday. The market fell first after the opening in the early trading at 3321.2. The daily line was at the lowest position of 3315.1 and then the market rose. The European session was given a position of 3348.5 and then the market fell. The position of 3325.6 and then the market rose strongly. The daily line reached the highest position of 3361 and then the market fell rapidly. The market fell rapidly. The market was given a position of 3319 and then the market was at the end of the market. After a strong pull-up, the daily line finally closed at the 3355 position and the market closed with a large positive line with an upper and lower shadow line. After this pattern ended, today's market had a long technical demand. At the point, today's 3335 long stop loss 3329, the target is 3357 and 3365 and 3375. The breaking position looks at the pressure of 3385-3388. If the breaking position is open, the upper space will open to the pressure of 3392 and 3404 and 3412.

The silver market opened at 36.507 yesterday and the market rose slightly. The market fluctuated and fell. The daily line was at the lowest point of 36.009 and then the market consolidated. The daily line finally closed at 36.238 and then the market closed with a middle-yin line with a lower shadow line slightly longer than the upper shadow line. After this pattern ended, today's 36-long stop loss was 35.8, the target was 36.35 and 36.65, and the break was 37 and 37.5.

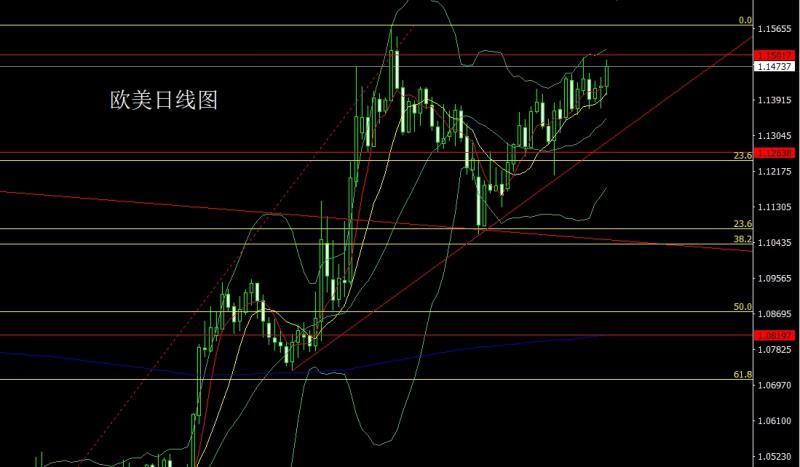

European and American markets opened at 1.14257 yesterday and the market fell first. The daily line was at the lowest point of 1.14044 and then the market rose strongly. The daily line reached the highest point of 1.14994 and then the market consolidated. The daily line finally closed at 1.14880 and then the market closed with a large positive line with a lower shadow line slightly longer than the upper shadow line. After this pattern ended, the stop loss of more than 1.14600 today is 1.14400, the target is 1.15000, and the break is 1.15200 and 1.15450 and 1.15550.

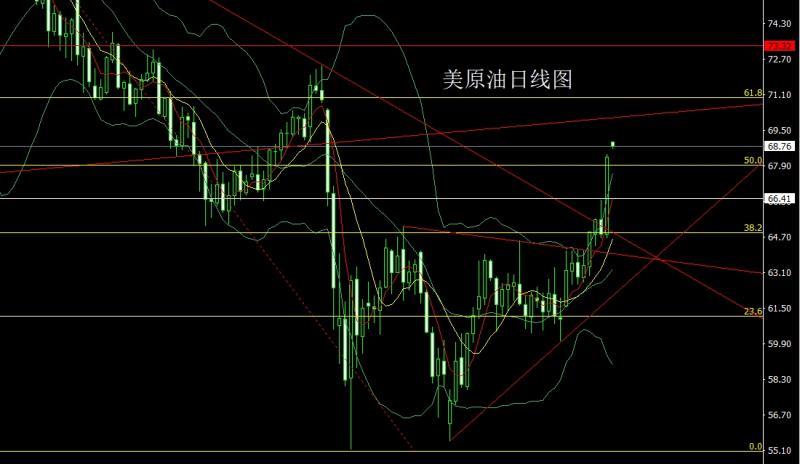

Yesterday, the US crude oil market opened at 64.82 in the morning and then fell slightly. After giving a 64.63 position, the market fluctuated strongly. After the position was inverted hammer head high of the previous day, it reached the highest point of 68.42. After the market consolidated, the daily line finally closed at 68.27. Then the market closed with a large positive line with an upper and lower shadow line. After this pattern ended, the 67.5 stop loss today was 67. The target was 68.3 and 68.8-69.

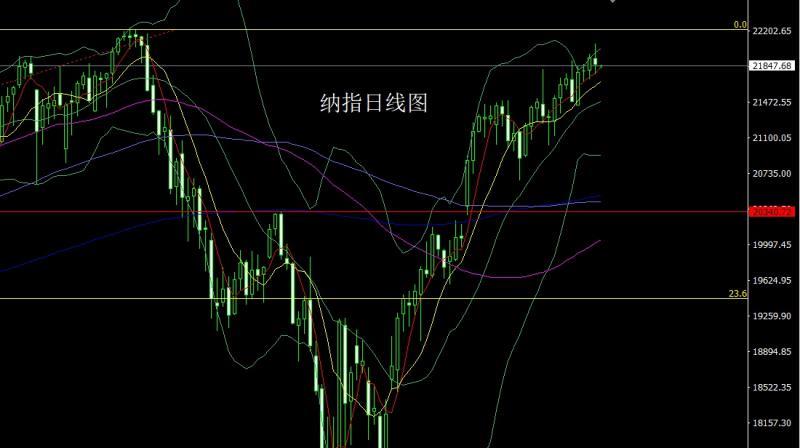

Nasdaq market opened at 21922.44 yesterday and the market fell first, giving the position of 21837.21, and then the market rose. The daily line reached the highest point of 22068.27, and then the market fell at the end of the trading day. The daily line was at the lowest point of 21763.58, and the market closed in a very long inverted hammer head pattern. After this pattern ended, today's market 22000 short stop loss 22100, with a target of 21800 and 21700 and 21600.

Brands, yesterday's fundamentals, the US May CPI data were all lower than expected, and the core CPI only grew by 0.1%. The US President then called on the Federal Reserve to cut interest rates by 100 basis points. The curfew was imposed in downtown Los Angeles until 6 a.m. local time on Wednesday. The US Attorney General said The U.S. President will use the Hobbs Act in California, and tensions in the Middle East are surging sharply. The U.S. president said his confidence in reaching the Iranian nuclear agreement has weakened. The Iranian defense minister said that if the nuclear negotiations fail and conflict with the United States, Iran will hit U.S. military bases in the region. The U.S. authorizes U.S. families to voluntarily withdraw from the Middle East and reduce the size of U.S. missions in Iraq and Iraq. International crude oil soared 5% at one time, and gold rose by more than $20. It is reported that the possibility of the sixth round of nuclear negotiations in Iraq and the United States holding the sixth round of nuclear negotiations over the weekend is getting smaller and smaller. Against the backdrop of risk aversion, today's fundamentals mainly focus on the number of initial unemployment claims in the United States from 20:30 to June 7. This round is expected to be 240,000, with the previous value of 247,000. At the same time, look at the annual PPI rate of the United States in May and the monthly PPI rate of the United States in May.

In terms of operations, gold: 3335 more stop loss today 3329. The target is 3357 and 3365 and 3375. The breaking position looks at the pressure of 3385-3388. If the breaking position is open, the upper space will look at the pressure of 3392 and 3404 and 3412.

Silver: 36-long stop loss today 35.8, target 36.35 and 36.65, breaking the position and 37 and 37.5.

Europe and the United States: 1.14600-long stop loss today 1.14400, target 1.15000, breaking the position and 1.15200 and 1.15450 and 1.15550.

US crude oil: 67.5-long stop loss today, The target is 68.3 and 68.8-69.

Nasdaq Index: Today's market is 22000 short stop loss 22100, and the target is 21800 and 21700 and 21600.

The above content is all about "[XM official website]: The Middle East will promote risk aversion again, and gold and silver will benefit from low long", which is carefully www.xmserving.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

After doing something, there will always be experience and lessons. In order to facilitate future work, we must analyze, study, summarize and concentrate the experience and lessons of previous work, and raise it to the theoretical level to understand it.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here