Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Forex】--BTC/USD Forecast : Bitcoin Rallies Again as CPI Misses in America

- 【XM Market Analysis】--EUR/USD Forecast: Euro Weak Near 1.04

- 【XM Forex】--EUR/USD Analysis: Future Parity Price

- 【XM Group】--USD/JPY Forecast: US Dollar Continues to Pummel Japanese Yen

- 【XM Forex】--NASDAQ 100 Monthly Forecast: December 2024

market analysis

CPI may cool down unexpectedly, White House refutes the rumor of the candidate for Federal Reserve Chairman

Wonderful Introduction:

If the sea loses the rolling waves, it will lose its majesty; if the desert loses the dancing of flying sand, it will lose its magnificence; if life loses its real journey, it will lose its meaning.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange]: CPI may cool down unexpectedly, the White House refutes the rumor of the candidate for the Federal Reserve Chairman". Hope it will be helpful to you! The original content is as follows:

On June 11, early trading in Asia on Wednesday, Beijing time, the US dollar index hovered around 99.03. On Tuesday, as Sino-US trade negotiations entered the second day, the US dollar index fluctuated around the 99 mark and finally closed up 0.04% to 99.046. U.S. Treasury yields fell first and then rose, with the benchmark 10-year U.S. Treasury yields closed at 4.48%, and the 2-year U.S. Treasury yields closed at 4.033%. Spot gold once approached the $3300 mark during the session, and then continued to rise, reaching a high of $3349.1/ounce. The US market gave up all the gains in the day and finally closed down 0.09% to close at $3322.6/ounce; spot silver fell from a record high and finally closed down 0.63% to $36.53/ounce. International crude oil remained near its highs in the past seven weeks. WTI crude oil showed an inverted V-shaped trend, once standing above the $65 mark, then took a sharp turn and fell, finally closing down 0.14% to $64.47/barrel; Brent crude oil closed down 0.09% to $66.72/barrel.

Analysis of major currencies

Dollar Index: As of press time, the US dollar index hovers around 99.03. The dollar index fell back as the chief negotiator of the United States (US) and China held trade talks in London, and investors were anxious. The dollar has been hit hard in the past few months as new economic policies and unstable tariff announcements implemented by U.S. President Donald Trump has skeptical of the credibility of the dollar. Technically, if the U.S. dollar index successfully closes above the 99.20 level, it will move towards the resistance level in the 100.20–100.40 range.

Analysis of gold and crude oil market trends

1) Analysis of gold market trends

Which trading on Wednesday, gold trading around 3334.09. The current gold market is under the influence of multiple factors. Geopolitical tensions and global economic slowdown provide solid bottom support for gold prices, but optimistic expectations of Sino-US trade negotiations and the strengthening of the US dollar limit its upward space. In the short term, gold prices may fluctuate in the range of 3250 to 3350 US dollars per ounce, waiting for further clarity in CPI data and trade negotiations. In the long run, if global economic uncertainty continues to intensify, the attractiveness of gold as a safe-haven asset will be further highlighted, but the easing of the trade situation may put pressure on it in the short term.

2) Analysis of crude oil market trends

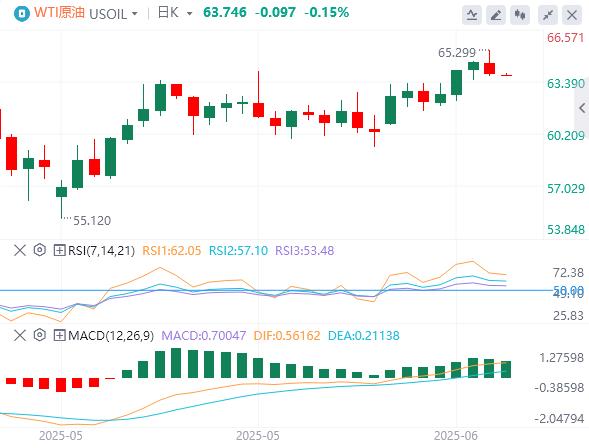

On Wednesday, crude oil trading around 63.74. Oil prices fell on Tuesday but remained near a seven-week high, as markets waited for the outcome of trade negotiations to guide the direction. Analysts say a trade deal between the two world's largest economies could support global economic growth and increase oil demand, boosting oil prices.

Forex market trading reminder on June 11, 2025

①20:30U.S. unseasonally adjusted CPI annual rate in May

②20:30U.S. seasonally adjusted CPI monthly rate in May

③20:30U.S. seasonally adjusted core CPI monthly rate in May

④20:30U.S. unseasonally adjusted core CPI annual rate in May

⑤22:30U.S. to June 6

⑥22:30U.S. to June 6

⑦22:30U.S. to June 6

22:30U.S. to June 6

22:30U.S. to June 6

22:30U.S. to June 6

⑦22:30U.S. to June 6

⑧The next day is 01:00U.S. to June 1110-year Treasury bond auction-winning interest rate

⑨The next day, 01:00 US to June 11, 10-year Treasury bond auction-tender multiple

The above content is all about "[XM Foreign Exchange]: CPI may unexpectedly cool down, the White House refutes the rumor of the candidate for the Federal Reserve Chairman" and is carefully www.xmserving.compiled by the editor of XM Foreign Exchange. I hope it will be helpful to your transaction! Thanks for the support!

In fact, responsibility is not helpless, it is not boring, it is as gorgeous as a rainbow. It is this colorful responsibility that has created a better life for us today. I will try my best to organize the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here