Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Group】--USD/JPY Forecast: US Dollar Continues to Wait for Bank of Japan

- 【XM Decision Analysis】--EUR/USD Analysis: Trading Begins Amid Selling Pressure

- 【XM Market Review】--Gold Analysis: Recovery May Be the Next Move

- 【XM Group】--USD/TRY Forecast: Turkish Lira Stabilizes Ahead of Turkey's Interest

- 【XM Group】--USD/CHF Forecast: Eyes Breakout Above 0.92

market news

Gold foreign exchange market fluctuates, and it is expected to break the range today

Wonderful Introduction:

A quiet path will always arouse a relaxed yearning in twists and turns; a huge wave, the thrilling sound can be even more stacked when the tide rises and falls; a story, only with regrets and sorrows can bring about a heart-wrenching desolation; a life, where the ups and downs show the stunning heroism.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Market Analysis]: The gold foreign exchange market is volatile, and it is expected to break the range today." Hope it will be helpful to you! The original content is as follows:

Macro

The Trump administration's policy shift has a profound impact on the financial market. On Tuesday, Trump signed an executive order to provide tax credits to automakers to mitigate the impact of tariffs. The U.S. dollar index rose 0.3% to 99.22, while gold prices fluctuated under pressure below $3,320. The secret trade agreement revealed by the U.S. Secretary of www.xmserving.commerce has relieved market anxiety. But behind this is the backlash of tariff policies on the economy. The www.xmserving.commodity trade deficit reached a new high of US$162 billion in March, which may drag down GDP decline by nearly 2 percentage points in the first quarter. At the same time, the consumer confidence index fell to a five-year trough in April, with job vacancies falling sharply. Goldman Sachs predicted that the economy would shrink by 0.8%, in contrast to the market's surface easing. As economic data approaches release, the market enters a critical period of gameplay. Tariffs have eased their risk-haven appeal, while economic slowdowns have strengthened Fed's expectations of interest rate cuts. The gap between policy expectations and economic reality will trigger greater market fluctuations. Investors face many uncertainties and need to pay close attention to economic data, policies and market sentiment, adjust strategies, predict interest rates, and grasp the rules of asset price fluctuations in order to achieve asset preservation and appreciation.

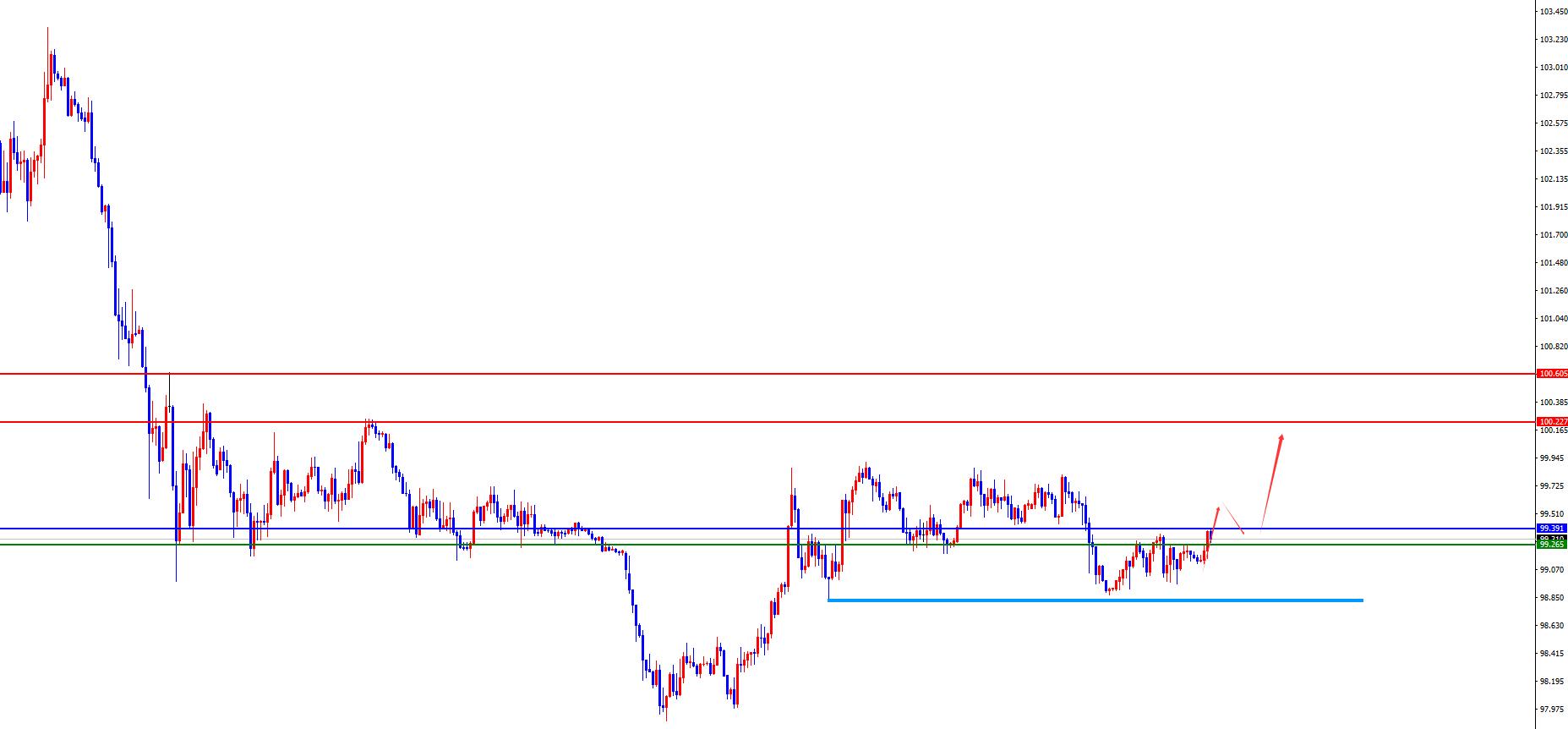

Dollar Index

In terms of the performance of the US dollar index, the US dollar index showed an upward trend on Tuesday. The price of the US dollar index rose to 99.349 on the day, and fell to 98.906 at the lowest, and finally closed at 99.188. Looking back at the market performance on Tuesday, the price first gained support in the early trading period and further rose, and then the price continued to fluctuate. From the position, the price is below the daily resistance position, but the subsequent market is expected to break through and stabilize again. Once the daily resistance is broken, you need to pay attention to the acceleration table in the future.now.

From a multi-cycle analysis, the price is suppressed in the 103.90 area of resistance, so from a medium-term perspective, the trend of the US dollar index will be more bearish. At the daily level, the price is suppressed at the resistance level of the 99.40 area, so the short seller will operate from the band perspective, but the price will break up again and stand on the daily resistance. The short-term four-hour support is 99.30. The price will remain relatively bullish in the short term. The upper part of the market will pay attention to the gains and losses of daily resistance. Once the price breaks up, the subsequent band is expected to start a wave of upward rise. Please pay attention to the market rhythm.

The US dollar index has a long range of 99.20-30, with a defense of 5 US dollars, and a target of 99.80-100.20-100.60

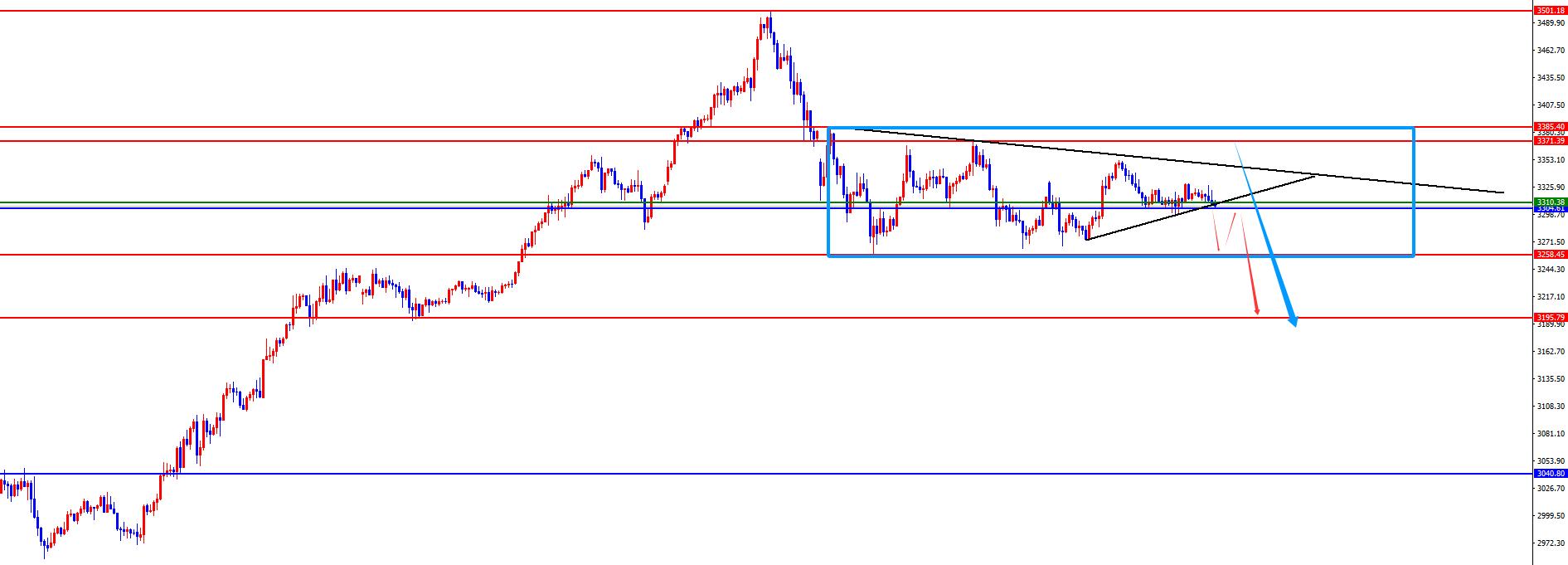

Gold

In terms of gold, the overall price of gold showed a decline on Tuesday. The price rose to the highest point of 3348.45 on the day, and fell to the lowest point of 3299.49 on the spot, closing at 3316.95 on the spot. Regarding Tuesday's gold was under pressure during the early trading session, and then the price continued to fluctuate during the European and US trading sessions. Overall, the price is still operating within the fluctuation range, but once the daily support breaks down, it is expected to break down the lower edge of the range.

From a multi-cycle analysis, first observe the monthly rhythm. The price has risen in the early stage for three months and then a single-month correction. Recently, it has risen in the recent four months and has seen a single-month correction. Therefore, according to the rhythm, the overall bullish look in April, but for May, we must pay attention to market risks. From the weekly level, gold prices are supported by the support level in the 3040 area. So from a mid-term perspective, we can continue to maintain a bullish view. From the daily level, the current price is supported by the 3004 regional support. This position is a key watershed in the band trend. The subsequent market will show further breaking, so the focus will be on the subsequent focus. At the same time, for the short-term four-hour upper price fluctuating and consolidation at a four-hour key position in the near future, pay attention to the resistance of 3387 and 3370 above, and pay attention to the 3260 area below. Before the data, the market generally tends to fluctuate temporarily. After the daily support is subsequently broken, then pay attention to the performance of the lower edge of the range.

Gold 3370-3371 is empty in the range, defense is 3390, and target is 3260-3200 (if it breaks the daily line first, you need to pay attention to the continuation in the future)

European and the United States

European and the United States, European and American prices generally showed a decline on Tuesday. The price fell to 1.1369 on the day and rose to 1.1421 on the spot and closed at 1.1384 on the spot. Looking back at the performance of European and American markets on Tuesday, the price of the morning opened first fell in the short term, and then continued to fluctuate during the day, and the price did not have any details.There is a downward break in the daily line and four-hour support, and the price ends with a big negative end, but it directly breaks down on Wednesday today, so the subsequent market tends to be further under pressure.

From a multi-cycle analysis, from the monthly level, Europe and the United States are supported by 1.0770, so long-term bulls are treated. From the weekly level, the price is supported by the 1.0840 area, and continue to look bullish from the perspective of the midline. From the daily level, the price broke the daily support at a recent high level and broke the daily support at 1.1380 area support in the early trading today, and it is short-term and bearish on the band. From the short-term four-hour level, the price has remained at a key four-hour position in recent days. At the same time, the current price has fallen below the daily line and four-hour support at the same time. In the short-term price is expected to be under further pressure and accelerate the decline. We will pay attention to the pressure in the four-hour and daily resistance areas in the future, and pay attention to the regional support of 1.0320-1.0270 below.

Europe and the United States have a short range of 1.1380-90, defense is 40 points, target 1.1320-1.1270

[Finance data and events that are focused today] Wednesday, April 30, 2025

①04:30 API crude oil inventories for the week from the United States to April 25

②09:30 China's April official manufacturing PMI

③09:30 Australia's first quarter CPI annual rate

>

④09:30 Australia's March weighted CPI annual rate

⑤09:45 China's April Caixin Manufacturing PMI

⑥13:30 France's first quarter GDP annual rate initial value

⑦14:00 UK's April Nationwide House Price Index monthly rate

⑧14:45 France's April CPI monthly rate

⑨15:00 Switzerland's April KOF leading indicator

⑩ 15:55 The number of unemployed people and unemployment rate in Germany after the seasonal adjustment in April

16:00 The initial value of the annual GDP rate of Germany in the first quarter

16:00 Switzerland April ZEW Investor Confidence Index

17:00 The initial value of the annual GDP rate of the euro zone for the first quarter

20:00 The initial value of the monthly CPI rate of Germany in April

20:15 The number of ADP employment in the United States in April

20:30 Canada February GDP P-monthly rate

20:30 The U.S. First Quarterly rate

20:30 The U.S. First Quarterly GDP and PCE Annualized Quarterly rate

20:30 The U.S. Department of Treasury released a quarterly refinancing statement

21:45 The U.S. April Chicago PMI

Note: The above is only personal opinion and strategy, for reference and www.xmserving.communication only, and does not give customers any investment advice. It has nothing to do with customers' investment, and is not used as a basis for placing an order.

The above content is all about "[XM Foreign Exchange Market Analysis]: The gold foreign exchange market fluctuates, and it is expected to break the range today". It was carefully www.xmserving.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Life in the present, don’t waste your current life in missing the past or looking forward to the future.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here