Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Decision Analysis】--Gold Forecast: Gold Continues to See Supporters

- 【XM Market Review】--AUD/USD Forecast: Drops as Bearish Trend Resumes

- 【XM Forex】--GBP/USD Analysis: Upward Trend Still in Its Early Stages

- 【XM Market Review】--USD/MXN Analysis: Nervous Sentiment Causing a Volatile Forex

- 【XM Decision Analysis】--Gold Analysis: Will Prices Continue to Rise?

market news

The rebound is weak and the baroness line is short when gold and silver are high

Wonderful introduction:

Without the depth of the blue sky, there can be the elegance of white clouds; without the magnificence of the sea, there can be the elegance of the stream; without the fragrance of the wilderness, there can be the emerald green of the grass. There is no seat for bystanders in life, we can always find our own position, our own light source, and our own voice.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Official Website]: The rebound is weak and the bare negative line is shorted when gold and silver are high." Hope it will be helpful to you! The original content is as follows:

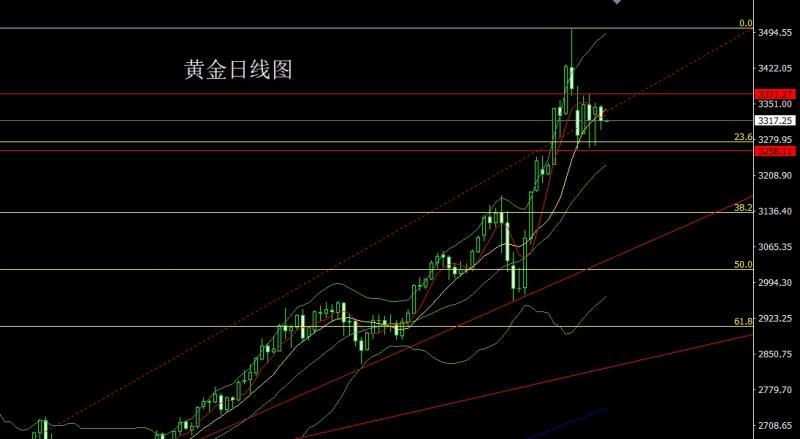

Yesterday, the gold market opened at 3345.9 in the morning and then rose slightly. The market fell sharply. The daily line was at 3299.4 and then rose strongly. The market was at 3330 and then consolidated. The daily line finally closed at 3317.3. Then the market closed with a very long lower shadow line. After this pattern ended, the short position of 3496, 3468 and 3442 last week, and the stop loss followed at 3400. The long position of 3273 was reduced by 3292. Yesterday, the long position of 3301-3303 left the market in the morning. Today, the short-short stop loss of 3350 is targeted at 3320 and 3310 and 3300. If it falls below, it looks at 3392 support. If the weekly pressure breaks, it will affect the market's decline process.

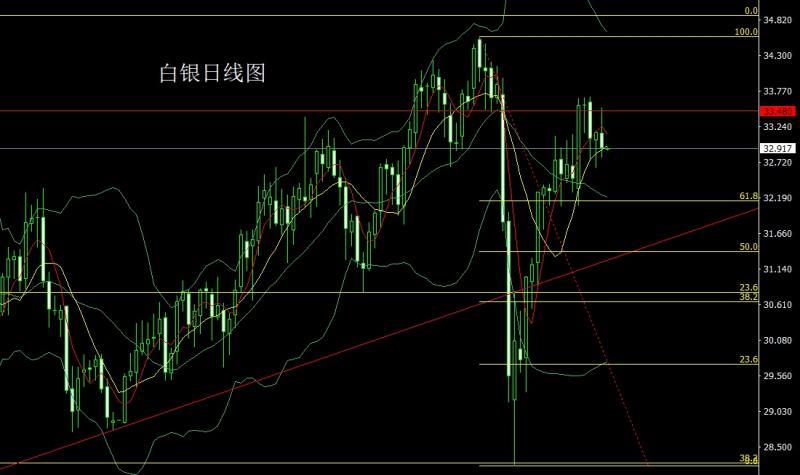

The silver market opened at 33.151 yesterday and the market fell first. The market rose strongly. The daily line reached the highest position of 33.525 and then the market rushed back to the lowest position of 32.787. The market consolidated. The daily line finally closed at 32.931. The market closed with an extremely long inverted hammer head pattern. After this pattern ended, the daily line rubbed and fluctuated. At the point, the short stop loss of 33.45 today at 33.25, and the target was 32.75 and 3.2.5 and 32.3-32.2.

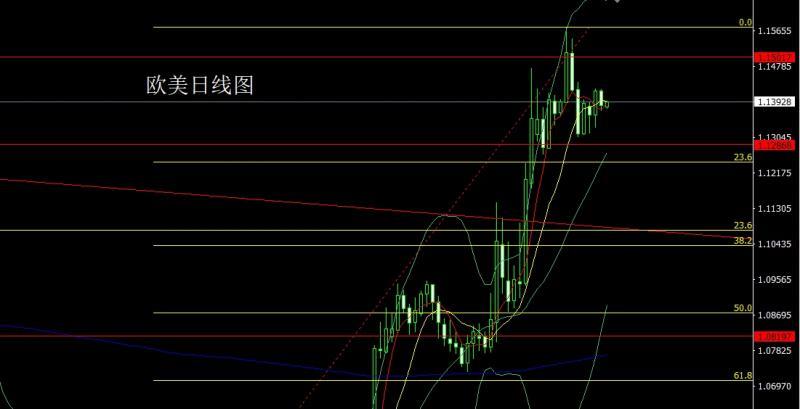

European and American markets opened at 1.14180 yesterday and the market rose slightly. After the market fell, the daily line was at the lowest point of 1.13690, the market rebounded. The daily line finally closed at 1.13838, and the market closed with a small negative line with a slightly longer lower shadow line. After this pattern ended, 1.14150 short stop loss was 1.14300, the target was 1.13800 and 1.13600, and the break below 1.13400 and 1.13200.

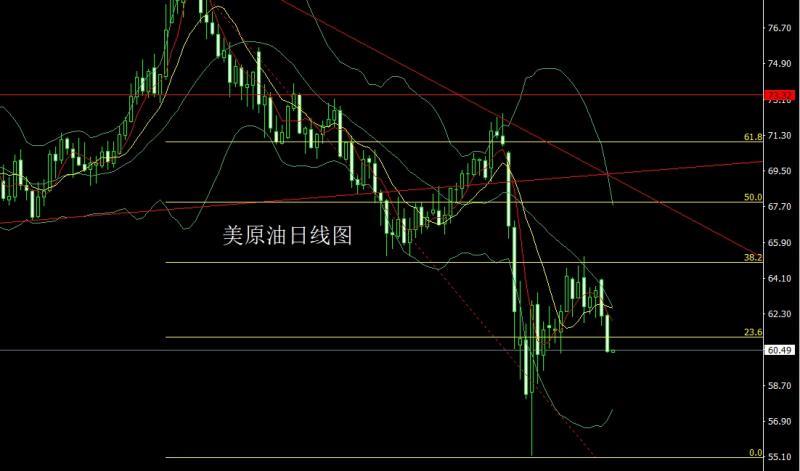

The US crude oil market opened at 62.23 yesterday and the market rose slightly. The market fluctuated and fell. The daily line was at the lowest point of 60.36 and then the market consolidated. The daily line finally closed at 60.42 and then the market closed with a large basically saturated negative line. After this pattern ended, it continued to short today. At the point, the short stop loss of 61.3 today is 61.8. The target is 60.35, and the break below 60 and 59.5 and 59.

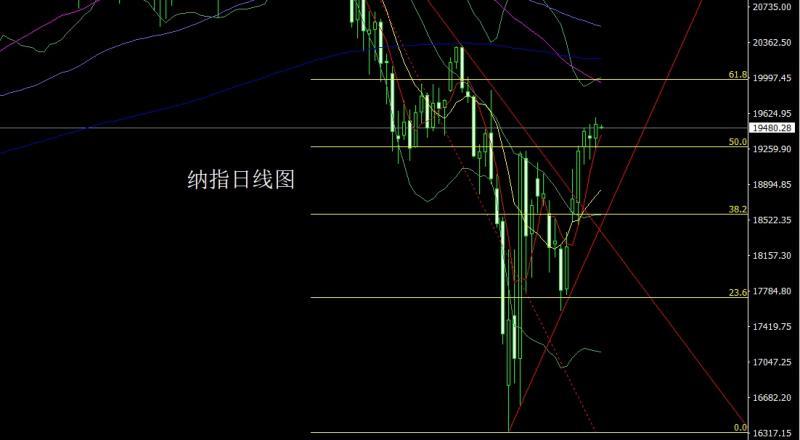

The Nasdaq market opened at 19370.08 yesterday and the market rose slightly, giving the position of 19529.94, and then the market fell. The daily line was at the lowest point of 19271.11, and then the market rose at the end of the trading session. The daily line reached the highest point of 19585.77, and then the market consolidated. The daily line finally closed at 19512.18, and then the market closed with a medium-positive line with a lower shadow line slightly longer than the upper shadow line. After this pattern ended, the stop loss of 19350 is more than 19250 today, with a target of 19580, and a break of 19650 and 19750.

Fundamentals, yesterday's fundamental tariff issue, the US President relaxed the automobile tariff policy to mitigate the impact on local auto manufacturers. US Secretary of www.xmserving.commerce: A trade agreement has been reached with an anonymous country. People familiar with the matter: The US president plans to use AI chips as a new bargaining chip in trade negotiations. US media: The United States said that Europe has not participated well in the tariff issue. Walmart notified Chinese suppliers to resume shipments. Goldman Sachs' latest research report stated that the U.S. www.xmserving.commodity trade deficit widened significantly in March than expected. Imports and exports of goods both increased in March. The main reason for the widening trade deficit is the increase in imports of consumer goods, which may reflect the "snatch-up" of imports before tariffs are raised. Details of the Leading Economic Indicators report show that import growth is significantly stronger www.xmserving.compared to our previous GDP tracking assumptions, but export growth has moderately strengthened and inventory accumulation has accelerated. Overall, we will be beautifulThe country's GDP tracking forecast for the first quarter was lowered by 0.6 percentage points to -0.8%, so gold is supported by the heating of risk aversion. Today's fundamentals mainly focus on the number of American ADP employment in April at 20:15. This round is expected to be 108,000, and the previous value is 155,000. Then look at the 20:30 quarterly rate of the US labor cost index and the initial value of the US real GDP annualized quarterly rate in the first quarter and the initial value of the US real personal consumption expenditure quarterly rate in the first quarter, and the initial value of the US core PCE price index annualized quarterly rate in the first quarter. Then look at the Chicago PMI in April at 21:45, and look at the annual rate of the core PCE price index in March at 22:00 and the monthly rate of personal expenditure in March at 22:00, as well as the monthly rate of the existing home contract sales index in March at the United States and the monthly rate of the core PCE price index in March at the United States. Look later at 22:30 U.S. to April 25 EIA crude oil inventories and U.S. to April 25 EIA Cushing crude oil inventories and U.S. to April 25 EIA strategic oil reserve inventories.

In terms of operation, gold: last week, the short position reduction of 3496, 3468 and 3442, the stop loss followed by 3400, and the long position reduction of 3273, the day before yesterday, the stop loss followed by 3292. Yesterday, the long position reduction of 3301-3303 left the market early. Today, the short-short stop loss of 3350 is targeted at 3320 and 3310 and 3300. If it falls below, it looks at 3392 support. If the weekly pressure breaks, it will affect the market's decline process.

Silver: 33.45 short stop loss today at 33.25, targets at 32.75 and 32.5 and 32.3-32.2.

Europe and the United States: 1.14150 short stop loss 1.14300, targets at 1.13800 and 1.13600, and below at 1.13400 and 1.13200.

U.S. crude oil: 61.3 short stop loss today 61.8. Target is 60.35, 60 and 59.5 and 59.

Nasdaq Index: 19350 stop loss today 19250 stop loss today, 19580, 19650 and 19750.

Yesterday 3301-3303 more

The above content is all about "[XM Forex Official Website]: The rebound is weak, and gold and silver short at highs". It is carefully www.xmserving.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Only the strong know how to fight; the weak are not qualified to fail, but are born to be conquered. Step up to learn the next article!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here