Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Review】--Canada 60 Forecast: Consolidates Amid Strong Jobs Data

- 【XM Market Review】--AUD/USD Forex Signal: Forecast as It Sits at a Key Support L

- 【XM Market Review】--GBP/USD Analysis: Under Pressure Before BoE

- 【XM Market Analysis】--USD/ZAR Monthly Forecast: December 2024

- 【XM Market Analysis】--Gold Analysis: Reaching its All-Time High

market analysis

Gold will continue to see adjustments in the short term, and it will be bearish again tonight

Wonderful introduction:

Walk out of the thorns, there is a bright road covered with flowers; when you reach the top of the mountain, you will see the cloudy mountain scenery like green clouds. In this world, a star falls and cannot dim the starry sky, a flower withers and cannot desolate the whole spring.

Hello everyone, today XM Forex will bring you "[XM official website]: Gold will continue to see the adjustment in the short term, and it will be bearish again tonight." Hope it will be helpful to you! The original content is as follows:

Zheng's silver spot: Gold continues to see adjustments in the short term, and it will remain bearish again tonight

Review yesterday's market trend and technical points:

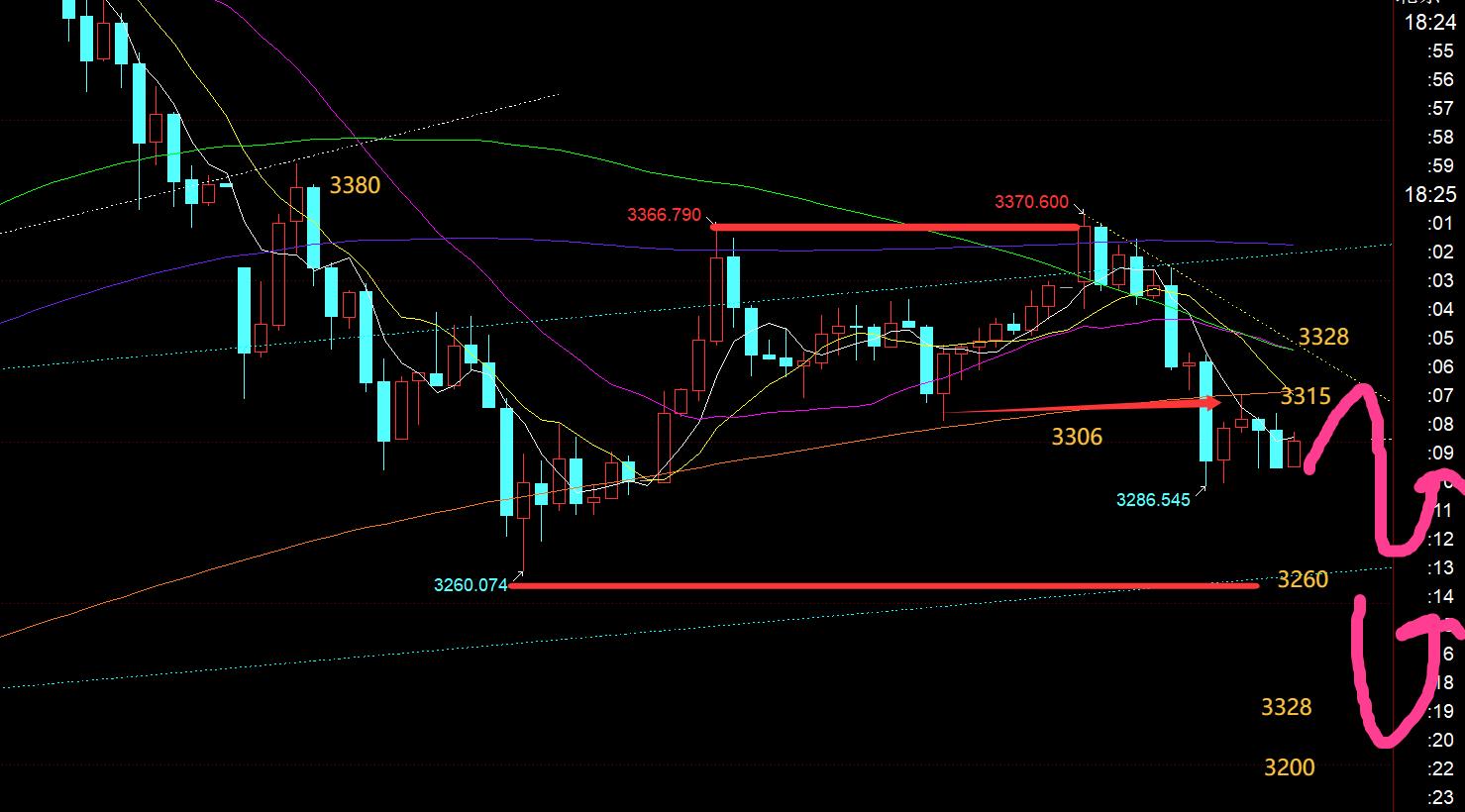

First, in terms of gold: In this week, only yesterday's layout failed, and the day's intraday was relatively worried; originally closed with a weak overnight closing the day before, but the first rise the next morning was to test to continue suppressing the bearishness, and the selected position was 333 The 8 line, that is, yesterday's decline rebounded and 618 divided resistance, is also the top-bottom conversion position, and is also the daily trend line counterpression point, multiple resonances, and a good reference point. As a result, the continuous pulling force in the early morning exceeded expectations, crossed 3338 and hit the 3366 line; then plan to wait for the 3380 line to continue to try bearishness, but do not give a chance; when it surges and falls in the afternoon and hits back below the counterpression line, it is prompted to see 3334 and 3345 in batches. 3345 has not reached the gap, 3345 has not reached the gap, 3334 has been holding for seven or eight hours, but it has not been able to fall well. The US conservatively chose to make a small profit before the market, but it was not long after, and the decline of 30 US dollars was reached; the hourly line is big negative and breaks down, and then the short-term bearish ended, relying on the 618 division resistance to 3330, the target difference is 2 US dollars, and the second half of the night is volatile and washes up the market;

Second, silver: the daily line is up Attack, yesterday's research report plans to fall back to 33 top and bottom support follows bullishness, and the price does not give a chance;

Today's market analysis interpretation:

First, gold daily line level: Yesterday closed a big positive, and the entity part almost swallowed up the previous day's negative K. It seems to want to stabilize, but in fact it still closed down but failed to break through the MA5 day on the 3057-3245 trend line pressure connected to the previous historical highs.Under the system; therefore, individuals still stick to bearish adjustments this morning, and in the end, they did weaken in the day, and once again lost the 3300 mark, reaching the current low of 3286; now, there are two yins that cover the yang, so the adjustment will continue at the beginning of next week; of course, this adjustment can be replaced by side trading, which means it is not ruled out that it will run back and forth within the 3260-3380 range, and finally a wave of temptation to break down with a heart-breaking arrow, and then stabilize the next day, ending the downward adjustment, and returning to the bullish trend, similar to the move in early March this year; for speculation The bottom area is still patiently waiting for 3228-3200. In theory, it should not fall below the top and bottom conversion position of 3167;

Second, gold 4-hour level: the middle track is under pressure again and effectively declines. At this time, the MA66 daily moving average support is slightly lost, and 3306 may become a certain counter-pressure. The strong pressure should be MA10. Relying on these two suppressions tonight, there is still room for further decline, pointing to the previous day's low of 3260 to see the gains and losses. If it continues to break down here, then the first attempted bottom position may be close;

Third, golden hourly line level: From the above chart, this morning, inertia was first rushed to pull a wave first, but it was still unable to effectively stand on the upper track of the previous blue channel, so the operating part of the 3370-3350 area was still a fake move, which induces long; when the 10-point line closes to the negative line and returns to the channel, it basically means that the 3350 line has become the key reverse pressure point again, and the US dollar began to rebound again, and the www.xmserving.combination of the two was judged that there would be a wave of downward movement today; therefore, in the morning, 3360 and 3350 prompted short-term bearishness, 3350 prompted bearishness in the band, and took a two-pronged approach, falling all the way to 3290 and harvesting that should be taken, and the protection of reducing holdings is really a pleasure! Tonight, the Asian session fell, the European session was weak and sideways, and the US session had a second decline. If you choose resistance, you can focus on the division between the current high and low points. 3318 and 3328 are 382 split resistance and 50 split resistance. In addition, the mid-track and 66-day moving average resistance also resonate at 3328; therefore, tonight is a strong pressure below 3328. At this position, you can try to continue bearish in batches. The aggressive resistance is 3306 mentioned in 4 hours, which is also the top and bottom of the hourly line, and the annual moving average is under pressure of 3315. These two small resistances are the pressure of the sideways of the European session, and the support is 3286 and 3292. Then down is the lower track of the 3260 line. When you arrive here, there may be some repeated pulling movements. After all, these days are treated as oscillations;

Silver: With the ease of tariffs, silver's industrial properties have also been utilized to a certain extent, so gold will plummet in the past few days, silver will resist the decline, or even pull up; daily level, the short-term moving average is arranged long again and returns to the previous upward channel. Today, we pay attention to the 33 and 32.7 stabilization and continue to be bullish, with resistance targets of 33.7, 33.9, 34.5, etc.;

In terms of crude oil: Continue to watch the oscillation repeatedly around the upper and lower tracks of the channel in the figure, with resistance below 65.3 and support above 61.1;

The above are several points of the author's technical analysis. As a reference, it is also a summary of the technical experience accumulated by watching and reviewing the market for more than 12 hours a day in the past twelve years. Technical points will be disclosed every day, and text and video interpretations will be interpreted. Friends who want to learn can www.xmserving.compare and refer to the actual trends; those who recognize ideas can refer to the operation. Lead defense well, risk control first; if you don’t agree, just drift by; thank everyone for your support and attention;

[The article views are for reference only. Investment is risky. You need to be cautious when entering the market, rationally operate, strictly set losses, control positions, risk control first, and bear the profit and loss at your own risk]

Contributor: Zheng’s Dianyin

A study on the market for more than 12 hours a day, persist for ten years, and detailed technical interpretations are made public on the entire network, serving the whole network with sincerity, sincerity, perseverance and wholeheartedness! www.xmserving.comments written on major financial websites! Proficient in the K-line rules, channel rules, time rules, moving average rules, segmentation rules, and top and bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content is all about "[XM official website]: gold continues to see adjustments in the short term, and it will remain bearish again tonight". It is carefully www.xmserving.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Only the strong know how to fight; the weak are not qualified to fail, but are born to be conquered. Step up to learn the next article!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here